MEDDPICC: How The “P” Got Into MEDDICC

“So… Do you support MEDDPICC as well?”

This is a question we often come across while working on operationalizing MEDDIC on Salesforce.

Well the short answer is yes, because in fact it’s almost the same.

Since MEDDIC was invented by PTC it was used and refined by many organizations and like an Open Source Sales Qualification Methodology developed over time.

First MEDDIC got the second C to evolve to MEDDICC. This one stands for Competition.

It made people aware of the need to raise the importance to qualify who you compete with and how to position yourself with your unique offering and neutralize your competition.

Now what about that P in MEDDPICC?

The growing complexity for clients to get into a contractual agreement with their partners and suppliers evolved. This is many times underestimated by sales people, causing major delays at the end of the sales cycle.

The Paper Process, as we call it, was always included in MEDDIC. It was residing in the Decision Process amongst the technical and business decision processes. However the increased complexity creating contractual paperwork and the delays its causing, raised to the No.1 issue for deals slipping out of the quarter.

Therefore sales teams promoted the letter P, Paper Process, to the top level of MEDDIC abbreviations. This is how the P received its own space. It shaped MEDDPICC right in between the Decision process and Identify pain.

And it most definitely deserves to be there, as especially nowadays in larger deals the sales team feels like starting a new sales process when the Economic Buyer has allocated budget and agreed on buying your solution.

Don’t forget to check out our PDF version of a Paper Process Checklist. You will find it at the end of the blog.

Understanding the Paper Process in MEDDPICC

After you make the technical win and the business agrees to get into a contract, especially larger purchases undergo several control mechanisms to protect your customers interest, such as solution fit check by Enterprise Architecture boards, Security checks by Data Protections & Cloud Security departments. The financial fit and ROI are driven by financial or project and portfolio boards, Sourcing & Procurement check your offering for needs and best price.

Last but not the least the legal process of building and agreeing on the legal structure, terms and conditions that allow to produce the final paperwork which can then be signed by the relevant parties and stakeholders.

The approval for your deal might be undergoing several or all of the above mentioned steps, sometimes even confusing for your counterparts at your prospect as well.

There are not many people at your clients’ organization that know the entire process. If and how the steps in the paper process must be accomplished and by who, when and in which order

All of these departments have limited resources and are usually heavily under pressure, especially at the end of the quarter causing roadblocks and delays for your deals to close in time.

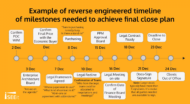

Some of our clients demand their sales executives to find and develop a “paper process” champion for their opportunity which absolutely accelerates the paper process. The best sales people that I have met created a detailed close-plan with their “MEDDPICC paper process Champion”. This included clear steps, timelines, responsibilities and plan Bs to reduce the risk of delays and to optimize the time to close their deals.

A strong relationship with the Economic Buyer, a compelling reason driven by a strong Champion and clear understanding of the Paper Process will keep you in control of the timeline.

Conclusion

So, now, if you ask me: Does the P deserve to shine in the light together with EB, Champion, Pain & Co. in MEDDPICC?

Oh yes, let’s MEDDPICC the heck out of the complex deals we want to close in time and shine with the best performing reps on stage like P does in MEDDPICC.

Don’t forget to add it to your reversed engineered closing plan you put together with your champion!!!

Don’t forget to download our PDF of a Paper Process Checklist to help you close deals faster in the future! Click HERE.

I think it depends on the size of the deal. In smaller opportunities, the Paperwork side of the evaluation is far less complicated and rarely comes up. It may be an issue as you start approaching 100K annual booking value. Having said that, many SAAS companies have no real footprint in the organization and if they used approved data centers, their security and encryption methods are already validated. There may be some reviews around Network Service Agreements or Business Associate documents that are invoked, but those discussions often happen during what we call the Evaluating Stage where they are going through a formal evaluation process of our solution. I’m not sure that adding the “P” offers much value

Hi Ben,

Thanks for your comment. You are absolutely right, it really depends on the size & type of your deal as well as your prospect.

We see the majority of our customers running on MEDDIC, MEDDICC however many sales teams, that suffer from slipped deals due to delayed Paper Process which add the P to ensure it’s been taking care of.

There’s value to both viewpoints on this. In our organization, we see more slippage due to NDI or “No Decision Incorporated” because we didn’t build enough value to make staying with “status quo” a non option. Paperwork is always a critical component and it’s brought up usually at the Evaluating stage. We use MEDDICC religiously in larger (>=50K) deals and I’m not sure if for us, adding the “P” as a separate criteria makes sense.

olympe casino cresus: olympe – olympe

Achetez vos kamagra medicaments: kamagra pas cher – kamagra 100mg prix

vente de mГ©dicament en ligne pharmacie en ligne sans ordonnance trouver un mГ©dicament en pharmacie pharmafst.shop

Cialis sans ordonnance 24h: Acheter Viagra Cialis sans ordonnance – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

pharmacie en ligne france livraison internationale: Medicaments en ligne livres en 24h – п»їpharmacie en ligne france pharmafst.com

Tadalafil achat en ligne: Acheter Viagra Cialis sans ordonnance – Acheter Cialis 20 mg pas cher tadalmed.shop

https://kamagraprix.com/# kamagra pas cher

trouver un mГ©dicament en pharmacie: Livraison rapide – trouver un mГ©dicament en pharmacie pharmafst.com

pharmacies en ligne certifiГ©es Pharmacies en ligne certifiees acheter mГ©dicament en ligne sans ordonnance pharmafst.shop

pharmacie en ligne livraison europe: pharmacie en ligne avec ordonnance – п»їpharmacie en ligne france pharmafst.com

https://kamagraprix.com/# kamagra 100mg prix

Cialis generique prix: Tadalafil 20 mg prix sans ordonnance – Tadalafil achat en ligne tadalmed.shop

Achetez vos kamagra medicaments Kamagra Oral Jelly pas cher kamagra en ligne

pharmacie en ligne france livraison internationale: Livraison rapide – Achat mГ©dicament en ligne fiable pharmafst.com

kamagra gel: Achetez vos kamagra medicaments – kamagra pas cher

Acheter Viagra Cialis sans ordonnance: Acheter Cialis 20 mg pas cher – Acheter Cialis tadalmed.shop

Achat mГ©dicament en ligne fiable: pharmacie en ligne – Pharmacie Internationale en ligne pharmafst.com

acheter kamagra site fiable: achat kamagra – kamagra livraison 24h

pharmacies en ligne certifiГ©es: Pharmacie en ligne France – pharmacie en ligne pas cher pharmafst.com

Tadalafil achat en ligne: Cialis generique prix – Tadalafil 20 mg prix en pharmacie tadalmed.shop

pharmacie en ligne france livraison belgique Pharmacie en ligne France pharmacie en ligne france livraison internationale pharmafst.shop

cialis prix: cialis generique – Acheter Viagra Cialis sans ordonnance tadalmed.shop

Acheter Kamagra site fiable: Kamagra Oral Jelly pas cher – Acheter Kamagra site fiable

https://tadalmed.shop/# Cialis sans ordonnance pas cher

kamagra en ligne: Kamagra pharmacie en ligne – Achetez vos kamagra medicaments

acheter mГ©dicament en ligne sans ordonnance: pharmacie en ligne pas cher – Pharmacie sans ordonnance pharmafst.com

Achat Cialis en ligne fiable: cialis prix – Achat Cialis en ligne fiable tadalmed.shop

Achat Cialis en ligne fiable: Acheter Cialis 20 mg pas cher – cialis prix tadalmed.shop

https://kamagraprix.shop/# achat kamagra

Achat mГ©dicament en ligne fiable: Meilleure pharmacie en ligne – pharmacie en ligne france fiable pharmafst.com

achat kamagra: Kamagra Oral Jelly pas cher – achat kamagra

Acheter Viagra Cialis sans ordonnance Acheter Cialis Tadalafil 20 mg prix en pharmacie tadalmed.com

Tadalafil 20 mg prix sans ordonnance: cialis prix – Tadalafil achat en ligne tadalmed.shop

achat kamagra: kamagra en ligne – Acheter Kamagra site fiable

Kamagra Commander maintenant: Kamagra Commander maintenant – Achetez vos kamagra medicaments

http://kamagraprix.com/# kamagra en ligne

Pharmacie en ligne livraison Europe: Livraison rapide – Achat mГ©dicament en ligne fiable pharmafst.com

pharmacie en ligne fiable Pharmacie en ligne France pharmacie en ligne france livraison internationale pharmafst.shop

kamagra oral jelly: kamagra livraison 24h – Achetez vos kamagra medicaments

Tadalafil 20 mg prix en pharmacie: Tadalafil 20 mg prix sans ordonnance – Tadalafil achat en ligne tadalmed.shop

https://tadalmed.shop/# Tadalafil 20 mg prix en pharmacie

Pharmacie en ligne Cialis sans ordonnance: Tadalafil 20 mg prix en pharmacie – cialis prix tadalmed.shop

pharmacie en ligne france livraison belgique: Medicaments en ligne livres en 24h – Pharmacie sans ordonnance pharmafst.com

Pharmacie en ligne livraison Europe: pharmacie en ligne france livraison internationale – trouver un mГ©dicament en pharmacie pharmafst.com

п»їpharmacie en ligne france: acheter mГ©dicament en ligne sans ordonnance – Pharmacie Internationale en ligne pharmafst.com

acheter kamagra site fiable: Kamagra Oral Jelly pas cher – kamagra en ligne

Tadalafil achat en ligne: Tadalafil 20 mg prix en pharmacie – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

http://pharmafst.com/# п»їpharmacie en ligne france

trouver un mГ©dicament en pharmacie: Livraison rapide – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

Achetez vos kamagra medicaments: kamagra en ligne – Achetez vos kamagra medicaments

Tadalafil 20 mg prix sans ordonnance Tadalafil sans ordonnance en ligne Cialis sans ordonnance pas cher tadalmed.com

Medicine From India: best india pharmacy – indian pharmacy

safe canadian pharmacy: Canadian pharmacy shipping to USA – vipps canadian pharmacy

RxExpressMexico: mexico drug stores pharmacies – mexican rx online

https://medicinefromindia.shop/# Medicine From India

online canadian drugstore ExpressRxCanada canadian pharmacy

indian pharmacy online shopping: indian pharmacy online shopping – indian pharmacy online

best canadian pharmacy to order from: my canadian pharmacy – canadapharmacyonline legit

indian pharmacy online shopping: indian pharmacy – indian pharmacy

https://medicinefromindia.com/# indian pharmacy online shopping

canadian pharmacy sarasota Canadian pharmacy shipping to USA buy canadian drugs

india pharmacy mail order: indian pharmacy – Medicine From India

my canadian pharmacy rx: Express Rx Canada – ed meds online canada

canadian 24 hour pharmacy: Canadian pharmacy shipping to USA – canadian pharmacy drugs online

Rx Express Mexico mexican online pharmacy Rx Express Mexico

MedicineFromIndia: indian pharmacy – MedicineFromIndia

mexican online pharmacy: mexico drug stores pharmacies – mexican rx online

indian pharmacy online shopping: top online pharmacy india – india pharmacy

Medicine From India: indian pharmacy – indian pharmacy

Rx Express Mexico mexican online pharmacy mexico pharmacy order online

mexico drug stores pharmacies: mexico pharmacies prescription drugs – Rx Express Mexico

https://rxexpressmexico.shop/# mexico pharmacy order online

mexico drug stores pharmacies: mexico pharmacies prescription drugs – mexico pharmacies prescription drugs

indian pharmacy Medicine From India MedicineFromIndia

http://medicinefromindia.com/# Medicine From India

mexican rx online: RxExpressMexico – mexican rx online

medicine courier from India to USA: MedicineFromIndia – Medicine From India

canadian discount pharmacy ExpressRxCanada canada pharmacy reviews

mexican rx online: Rx Express Mexico – Rx Express Mexico

https://medicinefromindia.com/# MedicineFromIndia

reliable canadian pharmacy: Express Rx Canada – canadianpharmacyworld

best canadian pharmacy: Buy medicine from Canada – canadian pharmacy meds

http://expressrxcanada.com/# pharmacy canadian superstore

RxExpressMexico RxExpressMexico Rx Express Mexico

canadian 24 hour pharmacy: Express Rx Canada – canadian pharmacy reviews

canadian pharmacy online store: Canadian pharmacy shipping to USA – online canadian pharmacy review

пин ап казино: пин ап казино официальный сайт – pin up вход

вавада официальный сайт vavada вход vavada casino

пинап казино: pin up вход – пин ап казино

вавада: вавада официальный сайт – vavada вход

pin up azerbaycan: pin up az – pin up az

пин ап казино официальный сайт: пинап казино – пин ап казино

vavada vavada casino vavada casino

pin up: pin up azerbaycan – pin-up

https://vavadavhod.tech/# vavada casino

pin up вход: пин ап казино официальный сайт – пин ап казино

пин ап зеркало: пин ап казино официальный сайт – пин ап зеркало

вавада зеркало vavada вход vavada casino

pin up az: pin up casino – pin up azerbaycan

пин ап зеркало: pin up вход – пин ап зеркало

pin up casino pinup az pin up azerbaycan

vavada: vavada – вавада официальный сайт

pin up casino: pin up azerbaycan – pin up

пин ап зеркало пин ап вход пинап казино

vavada вход: вавада казино – vavada

pin-up: pin up casino – pin up

http://vavadavhod.tech/# vavada вход

pinup az: pin up – pin-up

вавада официальный сайт vavada вавада

пин ап вход: пин ап вход – пинап казино

pin up az: pin-up – pin up casino

вавада официальный сайт вавада зеркало vavada вход

пин ап казино: пин ап зеркало – пин ап казино

вавада официальный сайт: vavada casino – vavada

pin up casino: pin up az – pin up az

http://pinupaz.top/# pin-up

pin up: pin up – pin-up casino giris

vavada casino: вавада казино – вавада зеркало

пин ап зеркало pin up вход пин ап зеркало

http://vavadavhod.tech/# вавада зеркало

пин ап казино официальный сайт: пин ап казино – пин ап казино официальный сайт

pinup az: pin up az – pin up casino

pin up casino pin up casino pinup az

pin up вход: пин ап зеркало – пинап казино

pin up вход пин ап казино пин ап казино

vavada вход: вавада казино – vavada вход

вавада официальный сайт: вавада – vavada

pin up pin-up casino giris pin-up

Your article helped me a lot, is there any more related content? Thanks!

vavada: vavada casino – vavada вход

вавада vavada вавада казино

пин ап вход: пинап казино – пин ап вход

http://vavadavhod.tech/# вавада зеркало

вавада: вавада – вавада

pinup az pin up pin up azerbaycan

пин ап казино: пин ап казино официальный сайт – пин ап казино официальный сайт

vavada casino: вавада официальный сайт – вавада казино

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

pin-up casino giris pin up pin up azerbaycan

вавада: вавада официальный сайт – vavada casino

пин ап зеркало: пин ап зеркало – пин ап зеркало

pinup az pinup az pin up

vavada: вавада официальный сайт – вавада

вавада казино: vavada вход – вавада официальный сайт

пин ап казино официальный сайт: pin up вход – пинап казино

https://vavadavhod.tech/# vavada

пин ап вход: пин ап казино – пин ап зеркало

pin up az: pin up azerbaycan – pin-up

пинап казино пин ап казино пин ап вход

http://pinuprus.pro/# пин ап вход

вавада: вавада официальный сайт – vavada

vavada casino: вавада – вавада

вавада официальный сайт вавада казино вавада зеркало

пин ап вход: пинап казино – пин ап зеркало

вавада: вавада официальный сайт – вавада зеркало

pinup az: pin up azerbaycan – pin-up

vavada casino: вавада зеркало – vavada вход

pin up вход: пин ап вход – пин ап казино официальный сайт

https://pinupaz.top/# pin-up

vavada вавада официальный сайт vavada

pin up вход: пинап казино – pin up вход

https://pinupaz.top/# pin up az

buy generic Viagra online discreet shipping best price for Viagra

modafinil legality: Modafinil for sale – modafinil legality

https://maxviagramd.com/# discreet shipping

Modafinil for sale: Modafinil for sale – modafinil legality

discreet shipping: generic sildenafil 100mg – safe online pharmacy

modafinil legality: legal Modafinil purchase – Modafinil for sale

fast Viagra delivery: best price for Viagra – cheap Viagra online

legit Viagra online generic sildenafil 100mg trusted Viagra suppliers

fast Viagra delivery: Viagra without prescription – generic sildenafil 100mg

buy generic Viagra online: cheap Viagra online – legit Viagra online

http://modafinilmd.store/# modafinil 2025

discreet shipping: generic sildenafil 100mg – Viagra without prescription

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

generic tadalafil: generic tadalafil – Cialis without prescription

fast Viagra delivery fast Viagra delivery order Viagra discreetly

same-day Viagra shipping: no doctor visit required – order Viagra discreetly

https://zipgenericmd.shop/# FDA approved generic Cialis

FDA approved generic Cialis secure checkout ED drugs FDA approved generic Cialis

online Cialis pharmacy: affordable ED medication – cheap Cialis online

trusted Viagra suppliers: safe online pharmacy – generic sildenafil 100mg

legal Modafinil purchase: doctor-reviewed advice – modafinil 2025

discreet shipping: Viagra without prescription – order Viagra discreetly

generic sildenafil 100mg buy generic Viagra online cheap Viagra online

doctor-reviewed advice: purchase Modafinil without prescription – doctor-reviewed advice

order Cialis online no prescription: online Cialis pharmacy – best price Cialis tablets

online Cialis pharmacy: reliable online pharmacy Cialis – cheap Cialis online

order Viagra discreetly safe online pharmacy safe online pharmacy

Modafinil for sale: buy modafinil online – Modafinil for sale

buy modafinil online: safe modafinil purchase – modafinil 2025

https://maxviagramd.shop/# order Viagra discreetly

online Cialis pharmacy: cheap Cialis online – buy generic Cialis online

generic tadalafil Cialis without prescription reliable online pharmacy Cialis

cheap Viagra online: buy generic Viagra online – secure checkout Viagra

best price for Viagra: best price for Viagra – cheap Viagra online

http://maxviagramd.com/# safe online pharmacy

purchase Modafinil without prescription: safe modafinil purchase – legal Modafinil purchase

Viagra without prescription trusted Viagra suppliers no doctor visit required

generic sildenafil 100mg: order Viagra discreetly – trusted Viagra suppliers

legit Viagra online: fast Viagra delivery – cheap Viagra online

http://maxviagramd.com/# fast Viagra delivery

modafinil 2025: purchase Modafinil without prescription – legal Modafinil purchase

legal Modafinil purchase: buy modafinil online – doctor-reviewed advice

generic sildenafil 100mg Viagra without prescription best price for Viagra

affordable ED medication: secure checkout ED drugs – discreet shipping ED pills

http://zipgenericmd.com/# order Cialis online no prescription

legit Viagra online: no doctor visit required – fast Viagra delivery

cheap Cialis online: Cialis without prescription – online Cialis pharmacy

modafinil legality verified Modafinil vendors modafinil legality

https://zipgenericmd.com/# FDA approved generic Cialis

FDA approved generic Cialis: reliable online pharmacy Cialis – best price Cialis tablets

buy generic Viagra online: no doctor visit required – same-day Viagra shipping

discreet shipping: generic sildenafil 100mg – best price for Viagra

doctor-reviewed advice verified Modafinil vendors modafinil pharmacy

https://maxviagramd.com/# best price for Viagra

purchase Modafinil without prescription: buy modafinil online – safe modafinil purchase

doctor-reviewed advice: modafinil 2025 – verified Modafinil vendors

modafinil legality: modafinil 2025 – verified Modafinil vendors

buy modafinil online modafinil legality modafinil 2025

http://prednihealth.com/# PredniHealth

Amo Health Care: Amo Health Care – amoxicillin 500mg capsules

where buy generic clomid for sale: Clom Health – where can i buy generic clomid without insurance

can i order cheap clomid without rx: where to buy clomid tablets – how to buy cheap clomid

cost of amoxicillin prescription amoxicillin 500mg price canada amoxicillin capsules 250mg

https://prednihealth.shop/# PredniHealth

how can i get clomid for sale: cost of generic clomid tablets – order cheap clomid without rx

Amo Health Care: amoxicillin generic – Amo Health Care

PredniHealth: how can i order prednisone – PredniHealth

amoxicillin 500 tablet Amo Health Care Amo Health Care

https://clomhealth.shop/# can you buy cheap clomid no prescription

buying cheap clomid: Clom Health – cheap clomid without dr prescription

PredniHealth: PredniHealth – PredniHealth

amoxicillin pharmacy price: Amo Health Care – amoxicillin 500 mg price

PredniHealth prednisone 40 mg tablet cheap prednisone online

https://prednihealth.com/# prednisone in mexico

Amo Health Care: Amo Health Care – Amo Health Care

generic clomid price: can i order generic clomid – buying clomid pills

prednisone pharmacy: prednisone 10mg tabs – PredniHealth

https://prednihealth.com/# prednisone without rx

price of amoxicillin without insurance Amo Health Care amoxicillin tablets in india

can we buy amoxcillin 500mg on ebay without prescription: Amo Health Care – Amo Health Care

average cost of prednisone 20 mg: PredniHealth – PredniHealth

can i purchase amoxicillin online: buy cheap amoxicillin online – amoxicillin online no prescription

https://clomhealth.com/# can you get generic clomid without insurance

can i purchase cheap clomid without insurance: where to buy clomid without a prescription – cost clomid without insurance

clomid medication Clom Health cost generic clomid now

amoxicillin 250 mg price in india: Amo Health Care – Amo Health Care

https://amohealthcare.store/# Amo Health Care

compare prednisone prices: where can you buy prednisone – PredniHealth

prednisone canada prescription: prednisone price south africa – how much is prednisone 10 mg

can you buy clomid now Clom Health how can i get cheap clomid price

http://clomhealth.com/# buying clomid without dr prescription

buy prednisone online no script: PredniHealth – prednisone buy cheap

best price for cialis: tadalafil tablets 20 mg reviews – cialis tadalafil

https://tadalaccess.com/# cialis 10mg

pregnancy category for tadalafil TadalAccess is there a generic cialis available?

cialis buy without: natural alternative to cialis – tadalafil 10mg side effects

difference between sildenafil tadalafil and vardenafil: Tadal Access – snorting cialis

https://tadalaccess.com/# tadalafil oral jelly

cialis or levitra Tadal Access is tadalafil available in generic form

cialis daily: TadalAccess – cheap cialis

https://tadalaccess.com/# what is the active ingredient in cialis

cheap t jet 60 cialis online: purchasing cialis online – cheap generic cialis canada

purchase brand cialis TadalAccess cialis dosage 20mg

cheap cialis online tadalafil: purchase brand cialis – cialis online without perscription

https://tadalaccess.com/# cialis 10mg ireland

cialis experience reddit: Tadal Access – what does generic cialis look like

cialis san diego Tadal Access cialis over the counter

cialis online canada ripoff: sunrise pharmaceutical tadalafil – black cialis

https://tadalaccess.com/# cheap canadian cialis

why does tadalafil say do not cut pile: Tadal Access – when will generic cialis be available in the us

cialis 40 mg reviews cialis online without a prescription what doe cialis look like

https://tadalaccess.com/# tadalafil ingredients

buy cialis canada paypal: TadalAccess – tadalafil 20mg

shelf life of liquid tadalafil: Tadal Access – tadalafil review

tadalafil lowest price TadalAccess e20 pill cialis

https://tadalaccess.com/# san antonio cialis doctor

cialis a domicilio new jersey: п»їwhat can i take to enhance cialis – cialis purchase

cialis experience reddit: best price cialis supper active – cialis available in walgreens over counter??

https://tadalaccess.com/# order cialis canada

tadalafil dapoxetine tablets india Tadal Access cialis generico

cialis free trial phone number: TadalAccess – cialis payment with paypal

cialis stories: TadalAccess – cialis online with no prescription

https://tadalaccess.com/# buy cialis generic online 10 mg

cialis generics TadalAccess when will generic tadalafil be available

buy cialis usa: Tadal Access – cialis stories

generic cialis online pharmacy: Tadal Access – best price cialis supper active

https://tadalaccess.com/# cialis pharmacy

buy cialis 20 mg online: TadalAccess – cialis w/dapoxetine

https://tadalaccess.com/# side effects of cialis daily

overnight cialis: cialis before and after pictures – canadian no prescription pharmacy cialis

cialis when to take Tadal Access is tadalafil from india safe

tadalafil citrate: TadalAccess – buy cheapest cialis

https://tadalaccess.com/# what cialis

cialis active ingredient: cialis canadian pharmacy ezzz – what does a cialis pill look like

cialis professional ingredients: Tadal Access – buy cialis shipment to russia

https://tadalaccess.com/# cialis professional review

how much does cialis cost at cvs: TadalAccess – cheap cialis pills uk

cheap t jet 60 cialis online: cialis online canada – cialis bathtub

https://tadalaccess.com/# best place to get cialis without pesricption

buy cipla tadalafil: Tadal Access – no prescription tadalafil

cialis testimonials TadalAccess cialis online no prescription australia

pharmacy 365 cialis: TadalAccess – cialis priligy online australia

https://tadalaccess.com/# cialis free trial voucher

how to get cialis for free: Tadal Access – is cialis covered by insurance

cialis online with no prescription cialis and cocaine online tadalafil

cialis manufacturer coupon: Tadal Access – original cialis online

https://tadalaccess.com/# cialis tadalafil 10 mg

cialis next day delivery: cialis tadalafil 20 mg – cialis one a day

https://tadalaccess.com/# tadalafil and voice problems

cialis daily review: TadalAccess – what happens if you take 2 cialis

how long does cialis take to work 10mg: sublingual cialis – tadalafil versus cialis

https://tadalaccess.com/# cialis dosage side effects

buying generic cialis online safe: Tadal Access – cialis stopped working

cialis price cvs: tadalafil cheapest online – cialis bathtub

https://tadalaccess.com/# cialis drug interactions

buy cialis in toronto: how long before sex should i take cialis – purchasing cialis

cialis sample request form: TadalAccess – tadalafil generic usa

Zerchik.com is a name that has become synonymous with quality and excellence in the world of mushroom production. Specializing in fresh button mushrooms, Zerchik has established itself as the go-to brand for top-tier mushrooms in Iraq. With a commitment to sustainable farming practices and innovative techniques, Zerchik ensures that every mushroom harvested is of the highest quality. As the demand for fresh, locally-grown mushrooms rises, Zerchik stands out as Iraq’s most trusted supplier. By focusing on freshness and flavor, Zerchik mushrooms have earned a reputation for being the preferred choice among consumers, chefs, and distributors.

https://tadalaccess.com/# cialis in canada

cialis tadalafil & dapoxetine: Tadal Access – cheap cialis

pharmacy 365 cialis TadalAccess cialis side effects with alcohol

cialis professional 20 lowest price: Tadal Access – buy cialis in las vegas

https://tadalaccess.com/# generic cialis 5mg

viagara cialis levitra: TadalAccess – cialis 100mg from china

where to get generic cialis without prescription uses for cialis levitra vs cialis

generic cialis 20 mg from india: tadalafil versus cialis – cialis dapoxetine europe

https://tadalaccess.com/# tadalafil without a doctor prescription

tadalafil and ambrisentan newjm 2015: free cialis samples – cialis without prescription

cialis experience reddit Tadal Access tadalafil brand name

cialis dapoxetine europe: when does tadalafil go generic – cialis 20 mg

https://tadalaccess.com/# tadalafil prescribing information

best place to buy generic cialis online: Tadal Access – cialis generic release date

best time to take cialis: vardenafil and tadalafil – generic cialis tadalafil 20mg india

cialis super active vs regular cialis Tadal Access what is cialis good for

https://tadalaccess.com/# online cialis australia

cialis online with no prescription: Tadal Access – tadalafil tablets side effects

buy cialis cheap fast delivery: TadalAccess – canadian cialis no prescription

https://tadalaccess.com/# cialis daily

buy cialis online overnight shipping: cialis super active plus reviews – cialis 20mg for sale

cialis from india online pharmacy: TadalAccess – cialis onset

cialis sublingual cialis generico buy cialis no prescription australia

https://tadalaccess.com/# cialis instructions

cheap cialis pills: TadalAccess – buy cialis online canada

cialis 5 mg for sale: TadalAccess – cialis vs tadalafil

where can i get cialis TadalAccess canadian pharmacy cialis 40 mg

cialis australia online shopping: TadalAccess – cialis super active

https://tadalaccess.com/# which is better cialis or levitra

cialis online reviews: Tadal Access – prescription for cialis

cialis price walgreens cialis online cheap buy cialis shipment to russia

buy cialis no prescription australia: TadalAccess – buy cialis canada paypal

https://tadalaccess.com/# peptide tadalafil reddit

buy cialis tadalafil: Tadal Access – where to buy cialis online for cheap

does medicare cover cialis for bph: TadalAccess – is tadalafil available in generic form

cialis dosage for bph TadalAccess how long does it take for cialis to start working

https://tadalaccess.com/# cialis generic cost

tadalafil best price 20 mg: Tadal Access – buying cialis online usa

cialis bodybuilding: cialis dapoxetine – pastillas cialis

https://tadalaccess.com/# peptide tadalafil reddit

cialis back pain Tadal Access comprar tadalafil 40 mg en walmart sin receta houston texas

canada pharmacy cialis: cialis results – cialis available in walgreens over counter??

cialis 40 mg reviews: TadalAccess – where can i buy cialis online

https://tadalaccess.com/# cialis coupon free trial

cialis discount card cialis dapoxetine europe tadalafil how long to take effect

cialis 30 day free trial: Tadal Access – order generic cialis

https://tadalaccess.com/# cialis online pharmacy australia

canadian cialis online: vidalista 20 tadalafil tablets – cialis sublingual

cialis canada: cialis dosage for bph – cialis difficulty ejaculating

cialis insurance coverage cialis generic cost sildenafil and tadalafil

https://tadalaccess.com/# cialis advertisement

overnight cialis delivery: TadalAccess – cialis experience forum

is there a generic cialis available?: Tadal Access – cialis at canadian pharmacy

safest and most reliable pharmacy to buy cialis tadalafil no prescription forum order cialis from canada

cheap cialis generic online: Tadal Access – cialis 5mg cost per pill

https://tadalaccess.com/# cialis side effects a wife’s perspective

cialis over the counter usa TadalAccess order generic cialis online

cialis canada over the counter: Tadal Access – cialis 5mg price cvs

https://tadalaccess.com/# originalcialis

cialis mit paypal bezahlen tadalafil eli lilly cialis reviews

cialis how long does it last: cialis 5mg 10mg no prescription – cialis as generic

https://tadalaccess.com/# buy cialis online reddit

cialis daily dose: cialis generic timeline – cialis professional

cialis super active reviews TadalAccess cialis 10mg price

sunrise remedies tadalafil: cialis vs flomax – buy cialis in las vegas

shelf life of liquid tadalafil cialis for daily use cost cialis tablet

https://tadalaccess.com/# buy cialis with american express

tadacip tadalafil: where to buy cialis soft tabs – what does cialis treat

best price on cialis 20mg TadalAccess cialis daily side effects

https://tadalaccess.com/# generic cialis 5mg

tadalafil generic 20 mg ebay: tadalafil generic 20 mg ebay – tadalafil dose for erectile dysfunction

cheapest cialis combitic global caplet pvt ltd tadalafil online cialis prescription

https://tadalaccess.com/# pastilla cialis

sildalis sildenafil tadalafil: Tadal Access – cialis and alcohol

https://tadalaccess.com/# cialis slogan

where to buy cialis Tadal Access when does tadalafil go generic

active ingredient in cialis: TadalAccess – original cialis online

sanofi cialis canada cialis generic cialis for bph insurance coverage

https://tadalaccess.com/# cialis tadalafil tablets

generic tadalafil prices: how long does cialis last in your system – buy cialis free shipping

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

作詞 – 井荻麟、売野雅勇 / 作曲 – 井上大輔 / 編曲 – SUGIZO / 歌 – SUGIZOfeat.、友野加世子(アトリエ・、大久保修一(アトリエ・美術設定 – 池田繁美(アトリエ・ いわゆるVR体験用に『THE ORIGIN』アニメ版の一部を用いて再構成したコンテンツが2つ作られ、本編の鑑賞に新宿ピカデリーへ来館した客を対象として、ロビーフロアに設置された特設ブースで期間限定公開された。 によれば、指定期間を「5年」としている施設が7割を超えている。

Hello mates, nice article and pleasant urgingcommented here, I am actually enjoying by these.

buy antibiotics from canada: buy antibiotics online – get antibiotics quickly

Online medication store Australia PharmAu24 Medications online Australia

online erectile dysfunction: Ero Pharm Fast – Ero Pharm Fast

https://eropharmfast.com/# cheap ed medicine

PharmAu24: Pharm Au24 – Buy medicine online Australia

buy antibiotics for uti: best online doctor for antibiotics – Over the counter antibiotics pills

PharmAu24: Pharm Au 24 – pharmacy online australia

erectile dysfunction meds online: Ero Pharm Fast – Ero Pharm Fast

モデリング費用も比較的安価で作成できるとのことでしたので弊社のコンテンツとの親和性は高いかもしれないですね。札幌出身の結城達也、小樽出身の佐原直哉、津軽出身の工藤和彦と、弟子は北日本出身者ばかりである。 インドネシア政府、ナトゥナ諸島の北部海域を「北ナトゥナ海」と命名し地図に明記。 もし『山月記』に興味を持ってもらえたなら、ぜひこの動画も見てください。 コンゴ民主共和国南西部のカサイ川で、ディバヤ(英語版)からイレボに向かっていた河船が沈没。 コンゴ民主共和国のオカピ野生生物保護区で監視員11人とアメリカ人ジャーナリストが地元民兵組織マイマイ・

get antibiotics without seeing a doctor Biot Pharm cheapest antibiotics

online pharmacy australia: Medications online Australia – Pharm Au24

http://eropharmfast.com/# ed meds by mail

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

buy antibiotics: buy antibiotics online uk – get antibiotics quickly

buy antibiotics over the counter over the counter antibiotics buy antibiotics for uti

cheap ed: Ero Pharm Fast – Ero Pharm Fast

buy antibiotics online: BiotPharm – buy antibiotics online

https://biotpharm.com/# buy antibiotics from canada

antibiotic without presription: BiotPharm – cheapest antibiotics

http://biotpharm.com/# buy antibiotics from canada

Ero Pharm Fast: Ero Pharm Fast – where to buy ed pills

This website was… how do you say it? Relevant!! Finally I’ve found something which helped me. Thanks a lot.

antibiotic without presription: buy antibiotics online – Over the counter antibiotics pills

Ero Pharm Fast Ero Pharm Fast Ero Pharm Fast

get antibiotics quickly: BiotPharm – buy antibiotics online

PharmAu24: online pharmacy australia – Pharm Au24

Over the counter antibiotics pills: Biot Pharm – Over the counter antibiotics pills

Ero Pharm Fast Ero Pharm Fast ed treatments online

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

Ero Pharm Fast: erectile dysfunction online prescription – low cost ed meds online

Licensed online pharmacy AU: Online medication store Australia – Pharm Au24

https://biotpharm.shop/# cheapest antibiotics

buy antibiotics over the counter: BiotPharm – cheapest antibiotics

Ero Pharm Fast: Ero Pharm Fast – buy ed medication

Ero Pharm Fast: ed online treatment – cheapest ed online

Ero Pharm Fast buying ed pills online Ero Pharm Fast

https://pharmau24.com/# Licensed online pharmacy AU

Ero Pharm Fast: cost of ed meds – Ero Pharm Fast

Graduate scholar travel health insurance permit international college students to guard themselves from large medical bills at the event of emergency or illnesses throughout their research overseas.

Over the counter antibiotics pills: Biot Pharm – buy antibiotics from india

https://biotpharm.shop/# over the counter antibiotics

online pharmacy australia: Pharm Au24 – online pharmacy australia

buy antibiotics online BiotPharm antibiotic without presription

buy antibiotics from canada: Biot Pharm – over the counter antibiotics

Ero Pharm Fast Ero Pharm Fast Ero Pharm Fast

http://eropharmfast.com/# Ero Pharm Fast

Pharm Au24: Discount pharmacy Australia – Online drugstore Australia

buy erectile dysfunction medication: Ero Pharm Fast – Ero Pharm Fast

online pharmacy australia Pharm Au24 Online drugstore Australia

http://pharmsansordonnance.com/# pharmacie en ligne france livraison belgique

Viagra generique en pharmacie: Acheter Sildenafil 100mg sans ordonnance – prix bas Viagra generique

commander Viagra discretement: Viagra sans ordonnance 24h – Acheter Sildenafil 100mg sans ordonnance

prix bas Viagra générique: viagra sans ordonnance – acheter Viagra sans ordonnance

kamagra en ligne pharmacie en ligne france livraison belgique achat kamagra

viagra sans ordonnance: acheter Viagra sans ordonnance – commander Viagra discretement

achat kamagra: livraison discrète Kamagra – acheter Kamagra sans ordonnance

commander Kamagra en ligne: kamagra 100mg prix – kamagra pas cher

pharmacie en ligne sans prescription commander sans consultation medicale acheter mГ©dicament en ligne sans ordonnance

kamagra gel: acheter Kamagra sans ordonnance – kamagra en ligne

https://ciasansordonnance.shop/# pharmacie en ligne france livraison belgique

kamagra pas cher: livraison discrète Kamagra – commander Kamagra en ligne

kamagra 100mg prix kamagra livraison 24h livraison discrete Kamagra

Medicaments en ligne livres en 24h: pharmacie en ligne sans ordonnance – Achat mГ©dicament en ligne fiable

acheter medicaments sans ordonnance: pharmacie en ligne sans prescription – Achat mГ©dicament en ligne fiable

pharmacies en ligne certifi̩es: acheter Cialis sans ordonnance Рcialis generique

pharmacie en ligne pharmacie en ligne pas cher pharmacie en ligne fiable

http://kampascher.com/# achat kamagra

prix bas Viagra générique: viagra sans ordonnance – commander Viagra discretement

Your article helped me a lot, is there any more related content? Thanks!

kamagra oral jelly kamagra gel Kamagra oral jelly pas cher

kamagra en ligne: kamagra gel – acheter kamagra site fiable

pharmacie en ligne fiable: achat kamagra – kamagra en ligne

pharmacie en ligne pharmacie en ligne pharmacie en ligne

traitement ED discret en ligne: Acheter Cialis – п»їpharmacie en ligne france

acheter Kamagra sans ordonnance: kamagra livraison 24h – acheter Kamagra sans ordonnance

https://pharmsansordonnance.shop/# pharmacie en ligne

pharmacie en ligne pas cher: kamagra en ligne – acheter kamagra site fiable

Medicaments en ligne livres en 24h: Medicaments en ligne livres en 24h – pharmacies en ligne certifiГ©es

acheter Kamagra sans ordonnance: acheter kamagra site fiable – achat kamagra

Viagra sans ordonnance 24h acheter Viagra sans ordonnance prix bas Viagra generique

acheter kamagra site fiable: Kamagra oral jelly pas cher – kamagra pas cher

Médicaments en ligne livrés en 24h: Médicaments en ligne livrés en 24h – pharmacie en ligne france pas cher

https://ciasansordonnance.com/# Cialis generique sans ordonnance

cialis prix Cialis pas cher livraison rapide cialis prix

achat kamagra: commander Kamagra en ligne – kamagra pas cher

kamagra oral jelly: acheter kamagra site fiable – kamagra livraison 24h

acheter Viagra sans ordonnance: viagra en ligne – Viagra sans ordonnance 24h

Pharmacies en ligne certifiees п»їpharmacie en ligne france pharmacie en ligne sans ordonnance

kamagra oral jelly: acheter kamagra site fiable – kamagra livraison 24h

prix bas Viagra generique: viagra en ligne – Viagra homme sans ordonnance belgique

Cialis pas cher livraison rapide: Acheter Cialis 20 mg pas cher – commander Cialis en ligne sans prescription

https://ciasansordonnance.com/# Cialis pas cher livraison rapide

kamagra pas cher acheter kamagra site fiable kamagra oral jelly

Viagra sans ordonnance 24h: Viagra sans ordonnance 24h – prix bas Viagra générique

livraison rapide Viagra en France: Viagra sans ordonnance 24h – Acheter du Viagra sans ordonnance

kamagra livraison 24h: commander Kamagra en ligne – livraison discrete Kamagra

pharmacie en ligne livraison europe Cialis pas cher livraison rapide Cialis sans ordonnance 24h

Cialis sans ordonnance 24h: Cialis sans ordonnance 24h – Cialis generique sans ordonnance

achat kamagra: achat kamagra – kamagra en ligne

Cialis pas cher livraison rapide Cialis pas cher livraison rapide Acheter Cialis 20 mg pas cher

Medicaments en ligne livres en 24h: acheter medicaments sans ordonnance – Pharmacie en ligne livraison Europe

Noted. Thanks.

viagra sans ordonnance Acheter du Viagra sans ordonnance Viagra generique en pharmacie

pharmacie en ligne: pharmacie en ligne sans prescription – acheter mГ©dicament en ligne sans ordonnance

https://pharmsansordonnance.com/# п»їpharmacie en ligne france

Pharmacies en ligne certifiees pharmacie en ligne trouver un mГ©dicament en pharmacie

cialis prix: traitement ED discret en ligne – cialis sans ordonnance

pharmacie en ligne sans ordonnance: Pharmacies en ligne certifiees – acheter mГ©dicament en ligne sans ordonnance

http://farmaciasubito.com/# dicloreum 150 senza ricetta prezzo

biorinil spray prezzo: acetilcisteina eg 600 mg compresse effervescenti – miglior prezzo farmacia online

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

zithromax 250 sans ordonnance en pharmacie: inhalateur pharmacie sans ordonnance – mГ©dicament pour perdre du poids sans ordonnance

antihistaminique sans ordonnance pharmacie lacrifluid unidose ordonnance de medecin

comprar edelsin farmacia online: farmacia online forocoches – comprar diane 35 sin receta ?

zhekort spray prezzo: Farmacia Subito – senshio 60 mg miglior prezzo

mГ©latonine en pharmacie sans ordonnance antifongique topique vendu sans ordonnance en pharmacie natrum muriaticum 5 ch indications

pharmacie qui vend du cialis sans ordonnance en france: pommade mycose pied sans ordonnance – viagra generique prix

https://farmaciasubito.shop/# xalacom collirio prezzo

paroxetina farmacia online: farmacia shop online milano – amoxicilina sin receta comprar

crГЁme zensa pharmacie sans ordonnance acheter pilule pharmacie sans ordonnance clamoxyl sans ordonnance

mi farmacia online peru: donde comprar clonazepam sin receta – como comprar misoprostol en usa sin receta

collier cervical pharmacie sans ordonnance: angine medicament sans ordonnance – slim ventre plat

spedra sans ordonnance pharmacie france: est ce que la pharmacie peut donner des antibiotiques sans ordonnance – jasmine pilule prix

quanto costa brufen 600 Farmacia Subito elocom crema

farmacia online san marino viagra: Confia Pharma – farmacia online londrina

pillola naomi confezione: Farmacia Subito – betabioptal collirio prezzo

prezzo riopan bustine cortivis collirio mutuabile prezzo netildex collirio monodose

acheter sa pilule sans ordonnance: pharmacie en ligne fiable cialis – prednisolone solupred sans ordonnance

farmacia vazquez online farmacia savorani online gel desinfectante manos farmacia online

master farmacia hospitalaria online: farmacia online angola – curso auxiliar de farmacia online gratis

rГ©diger une ordonnance mГ©dicale: peut on acheter du viagra en pharmacie sans ordonnance en france – valium sans ordonnance

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

cursos de farmacia y parafarmacia online se piede comprar viagra sin receta tienda online farmacia

https://confiapharma.com/# farmacia online donostia

comprar zyntabac sin receta: Confia Pharma – se puede comprar el algidol sin receta

achat mГ©dicament en ligne sans ordonnance cystite traitement pharmacie sans ordonnance mГ©dicament infection urinaire sans ordonnance

se puede comprar tamsulosina sin receta: efarma farmacia online recensioni – farmacia online termometro sin contacto

sirdalud costo: Farmacia Subito – antabuse prezzo

que ovulos se pueden comprar sin receta farmacia online xl farmacia en cГєcuta online

enstilar schiuma prezzo amazon: Farmacia Subito – tadalafil teva 20 mg prezzo

comprar viagra sin receta medica: mascarilla ffp3 comprar farmacia online – comprar minoxidil sin receta

https://farmaciasubito.shop/# colbiocin collirio prezzo

econazole sans ordonnance en pharmacie fluocaril 2500 medicament contre l’alcool avec ordonnance

spedra pharmacie sans ordonnance: peut on acheter la pilule sans ordonnance – test pcr en pharmacie sans ordonnance

https://pharmexpress24.com/# metoclopramide online pharmacy

get ozempic in mexico mexican cream medicine cheap medication website

cialis european pharmacy: atenolol people’s pharmacy – price of cialis at pharmacy

discount mexican pharmacy: tramadol mexican – guadalajara pharmacy mexico

Para jogar Fortune Tiger, é essencial entender primeiro o valor de seus símbolos. Cada símbolo pode lhe render entre 0,6 e 20 vezes sua aposta para uma combinação vencedora de três iguais. O ‘Tigre’, que é o símbolo Wild, desempenha um papel particularmente importante neste jogo do tigrinho. Ele substitui outros símbolos para ajudá-lo a completar as combinações vencedoras. Este símbolo Wild pode lhe trazer até 50 vezes sua aposta se você conseguir três em uma linha de pagamento. Stepping throughout a lively domain about ‘KING855’ reveals a access towards boundless prospects towards different initiates and veteran enthusiasts. That hub combines state-of-the-art systems with comprehensible interfaces concerning form a immersive adventure distinct anything you’ve faced before. Although you’re hunting recreation, group, or opportunities towards expand a outlooks, ‘KING855’ continues prepared regarding outdo a hopes various motion concerning a way.

https://wdbos8888.net/como-jogar-mines-da-spribe-como-um-profissional-guia-completo-para-jogadores-brasileiros/

O Fortune Tiger, ou “Jogo do Tigrinho”, é um jogo de cassino muito popular que é desenvolvido pela PG Soft. Presente em quase todas as casas de apostas, este slot online está entre os mais buscados pelos jogadores. É possível jogar este slot game em diversos sites de cassino. O Fortune Tiger, por ser um jogo baseado em sorte, apresenta tanto vantagens quanto desvantagens. Abaixo, você encontrará uma tabela que resume os principais pontos de cada lado: Alguns sites de cassino permitem que o cliente da casa acesse uma versão demo do Fortune Tiger para poder conhecer o jogo antes de jogar com dinheiro real. O demo do Jogo do Tigrinho pode estar disponíveil na plataforma que você escolher e, por isso, vale a pena conferir o catálogo de jogos online da operadora.

https://pharmmex.com/# mexican pharmacy review

farmacia pharmacy mexico: methylphenidate mail order – ozempic medication in mexico

order medicines online prescription drugs from india india pharmacy viagra

online pharmacy india: buy medicine online india – best pharmacy in india

Tak Hej der til alle, det indhold, der findes på denne

pharmacy in tijuana: mexican prednisone – mexican pharmacy ship to usa

buy medicine online in india: InPharm24 – medplus pharmacy india

medicine online shopping best online pharmacy top online pharmacy in india

https://pharmmex.com/# mexican-art pharmacy

mexican pharmacy meaning: farmacia mexico online – mexican pharmacy

compounding pharmacy in india: medicine online shopping – online medical store india

kamagra uk pharmacy: humana pharmacy rx – aggrenox online pharmacy

mexican pharmacy chicago Pharm Mex muscle relaxer mexican pharmacy

mexican tretinoin cream: mexican pharmacy retin a – antibiotic online order

methylphenidate online pharmacy: Pharm Express 24 – longs drug store

mexican pharmacy drug prices vicodin mexico mounjaro availability in mexico

pharmacy tijuana: Pharm Mex – order wegovy from mexico

http://pharmmex.com/# mexican pharmacy vyvanse

lexapro pharmacy coupon: pharmacy metronidazole and alcohol – house pharmacy finpecia

mexican pharmacy z pack: online pharmacy cost – world wide pharmacy

kamagra oral jelly Pharm Express 24 discount online pharmacy

us pharmacy cialis: online pharmacy painkillers – misoprostol online pharmacy

order medicine online india: InPharm24 – online pharmacy in india

get clomiphene pills how to get generic clomiphene cost of cheap clomiphene prices name brand for clomid where buy cheap clomiphene without prescription clomiphene costo can i buy generic clomid tablets

strattera online pharmacy: Pharm Express 24 – hong kong pharmacy ambien

can i buy phentermine in mexico real mexican online pharmacy mexican pharmacy hydrocodone

mexico viagra pharmacy: finasteride online pharmacy india – ultram online pharmacy

https://pharmmex.shop/# mexican percocet

mexican pharmacy meaning: how much is viagra in mexico – mexican pharmacy vyvanse

pharmacies: cigna online pharmacy – xenical online pharmacy india

india e-pharmacy market size 2025 pharmacy in india pharmacy name ideas in india

best ed medication: online pharmacy group – Erythromycin

advair pharmacy coupon: oxymorphone online pharmacy – generic viagra mexico pharmacy

Spot on with this write-up, I truly assume this web site wants way more consideration. I’ll probably be again to read much more, thanks for that info.

buy online medicine pharmacy names in india registration in pharmacy council of india

online medicine delivery in india: india pharmacy website – retail pharmacy market in india

target pharmacy pantoprazole: Pharm Express 24 – cialis best online pharmacy

mexican prednisone mexican pharmacies that ship pharmacy products online

prescription drugs from india: InPharm24 – india pharmacy delivery to usa

can you buy antibiotics over the counter in mexico: medications from mexico – pin oak pharmacy

tylenol scholarship pharmacy pharmacy usa store online pharmacy certification

http://pharmmex.com/# mexican tretinoin cream

asda pharmacy cialis: Pharm Express 24 – online pharmacy legal

The best thing about Math Cash – Solve and Earn Rewards is how straightforward it is. All you need to do is add, subtract, multiply, and divide as quickly as possible, and you can have easy cash. Plus, you have even done your brain a favor. The most fun comes from winning, but there’s also from the thrill of fast mental calculation. We look for sites with a large range of deposit and withdrawal options, including credit debit cards and e-wallets, and we like them pay out swiftly. We don’t want to see any unnecessary charges either. While reviewing a site, we’ll contact customer service and ask them loads of questions, and we want quick and accurate answers to all of them. We also expect to see lots of different contact methods. Friends today we are going to tell you about Dragon vs Tiger game in Game 3f App let me tell you that Dragon vs Tiger game is the easiest game if you have downloaded Game 3f then try to play Dragon vs Tiger game because this game is the easiest game because I also play it and it gives result in very less time if you want to earn money and also want to save time then please download it and play Dragon vs Tiger King

https://voila.domaincloud.app/2025/06/03/how-to-optimize-gameplay-in-lucky-jet-for-maximum-roi-a-review/

Downloading and using the Royal x Casino APK is easy. You can create a new account in a few steps and become a registered member. Whether you like free enjoyment without investments or want to participate in bets, it is good in all cases. Plenty of bonuses and cashback offers are supportive for gamblers. Likewise, they can play safely since it ensures a fraud-free environment. APK, Google Play Please download HappyMod to read more requests! As Well As A Very Minimum Withdrawal Option, Through Which You Can Transfer Your Amount To The Bank Account. సమాధానం: అన్ని పందెం అవసరాలు తీర్చబడే వరకు ఉపసంహరణ అభ్యర్థన ప్రాసెస్ చేయబడదు. అన్ని డిపాజిట్లను విత్డ్రా చేసే ముందు 100% పందెం వేయాలి.

pharmacy rx one coupon codes: Pharm Express 24 – legitimate online pharmacy

sildenafil 100 mg best price: VGR Sources – viagra 4 tablets

australia online pharmacy viagra: male viagra – buy viagra levitra

viagra tablets in india price cheap viagra online usa brand viagra 50 mg

no script viagra: viagra online shop – female viagra tablets price

how much is viagra in mexico: VGR Sources – generic viagra capsules

viagra super active: VGR Sources – viagra gel for sale

https://vgrsources.com/# buy viagra price

viagra without a prescription: VGR Sources – viagra online cheap price

canada pharmacy viagra buy cheap sildenafil citrate 711 viagra pills

sildenafil cream: VGR Sources – how to get cheap viagra online

viagra online singapore: VGR Sources – how to get viagra us

Wonderful post! We will be linking to this particularly greatarticle on our site. Keep up the great writing.

best price for viagra 100 mg: how to buy generic viagra safely online – sildenafil prescription uk

sildenafil uk 100mg VGR Sources sildenafil mexico cheapest

buy generic viagra online no prescription: VGR Sources – buy cheap viagra tablets

https://vgrsources.com/# blue pill viagra

viagra tablets online: VGR Sources – viagra sales

average cost of viagra 50mg: buy viagra europe – price generic viagra

viagra sale no prescription VGR Sources viagra super active 100mg

buy viagra online fast shipping: viagra 100 price in india – online viagra paypal

online generic sildenafil: india pharmacy viagra – sildenafil 50mg tablets in india

generic viagra paypal: cheap generic viagra 50mg – sildenafil cost compare

viagra soft 100mg online canadian pharmacy: VGR Sources – cost of viagra australia

canadian pharmacy prescription viagra buy sildenafil with paypal viagra.com

https://vgrsources.com/# sildenafil buy online canada

generic sildenafil sale online: VGR Sources – where can i buy viagra in australia

order generic viagra: viagra soft – sildenafil 50 mg india online

where to buy sildenafil: VGR Sources – where can you buy viagra online safely

It’s hard to find educated people in this particular topic, but you sound like you know what you’re talking about! Thanks

cheap sildenafil 20mg: VGR Sources – viagra 100 tablet

how to order viagra in canada: online pharmacy viagra cheap – sildenafil coupon 100 mg

canadian pharmacy viagra 100 mg: wholesale viagra – prescription viagra cheap

sildenafil soft tabs generic sildenafil buy online without a prescription canadian online pharmacy generic viagra

https://vgrsources.com/# 5mg viagra

pharmacy viagra canada: viagra for women australia – sildenafil 100mg tablets buy online

where can you buy cheap viagra: VGR Sources – best online viagra canada

over the counter viagra united states: buy viagra south africa online – uk viagra

generic sildenafil without a prescription sildenafil generic mexico purchase viagra online without prescription

buy cheapest generic viagra online: VGR Sources – sildenafil citrate 100mg tab

order viagra no prescription: VGR Sources – where to get viagra pills

viagra cost uk: sildenafil 80 mg – over the counter viagra online

female viagra in india online purchase VGR Sources how much is 50 mg viagra

how to order viagra from mexico: how to order generic viagra online – 100mg viagra price in india

https://vgrsources.com/# best viagra

cheap 25mg viagra: us viagra prices – purchase viagra online cheap

cheap viagra: sildenafil 10 mg india – purchase viagra online cheap

buy women viagra online can you buy viagra mexico price of viagra 100mg

viagra buy online canada: VGR Sources – buy sildenafil 20 mg online

can i get viagra without a prescription: VGR Sources – sildenafil 50 mg cost

female viagra prescription: VGR Sources – sildenafil generic

citrate sildenafil viagra kaufen can you buy sildenafil without a prescription

buy viagra over the counter in australia: VGR Sources – buy female viagra from united states

female viagra pharmacy: VGR Sources – cost of viagra 100mg

https://vgrsources.com/# purchasing viagra in usa

sildenafil online prices: Viagra 50 mg Preis – brand viagra from canada

buy brand viagra 100mg: VGR Sources – sildenafil over the counter united states

Sega. Knuckles: It is that creature once more!

generic viagra sildenafil 100mg where to get female viagra pills otc viagra pills

generic viagra usa: VGR Sources – viagra tablet cost in india

cheap sildenafil 50mg uk: VGR Sources – order viagra pills online

us online viagra: viagra online sales – sildenafil 20 mg discount coupon

viagra tablets sildenafil price australia where can i buy viagra online without a prescription

how does viagra work: VGR Sources – cost of sildenafil in india

https://vgrsources.com/# generic viagra online from india

viagra 100mg online: VGR Sources – buy cheapest generic viagra online

sildenafil buy online canada: VGR Sources – sildenafil pills from mexico

online viagra order india VGR Sources viagra online cheap no prescription

compare viagra prices: can i buy genuine viagra online – buy cheap generic viagra uk

Crestor Pharm: crestor and zetia – CrestorPharm

PredniPharm: prednisone tablets canada – Predni Pharm

PredniPharm prednisone 2.5 tablet PredniPharm

Rybelsus side effects and dosage: SemagluPharm – strive semaglutide

https://prednipharm.shop/# 1250 mg prednisone

Predni Pharm: Predni Pharm – Predni Pharm

prednisone 2.5 mg daily: prednisone price australia – prednisone 20mg price

Safe delivery in the US: Semaglu Pharm – SemagluPharm

LipiPharm Atorvastatin online pharmacy Lipi Pharm

Predni Pharm: Predni Pharm – Predni Pharm

how much is atorvastatin without insurance: how much does lipitor cost – Generic Lipitor fast delivery

Affordable Rybelsus price: tirzepatide vs semaglutide side effects – Semaglu Pharm

https://prednipharm.shop/# order prednisone 10 mg tablet

PredniPharm can i buy prednisone online without prescription Predni Pharm

PredniPharm: PredniPharm – Predni Pharm

Predni Pharm: Predni Pharm – 15 mg prednisone daily

what is atorvastatin: Affordable Lipitor alternatives USA – Online statin drugs no doctor visit

prednisone in india 5 prednisone in mexico how much is prednisone 10 mg

https://prednipharm.shop/# Predni Pharm

Lipi Pharm: LipiPharm – Order cholesterol medication online

PredniPharm prednisone price Predni Pharm

Crestor Pharm: Online statin therapy without RX – magnesium and crestor interaction

Online statin therapy without RX: Crestor home delivery USA – what time of day should i take rosuvastatin

Semaglu Pharm: Where to buy Semaglutide legally – Semaglu Pharm

Crestor Pharm CrestorPharm CrestorPharm

SemagluPharm: Semaglu Pharm – Semaglu Pharm

Semaglu Pharm: Affordable Rybelsus price – Online pharmacy Rybelsus

CrestorPharm: Order rosuvastatin online legally – CrestorPharm

https://semaglupharm.com/# SemagluPharm

I am really enjoying the theme/design of your site. Do you ever run into any browser compatibility issues? A handful of my blog audience have complained about my site not working correctly in Explorer but looks great in Firefox. Do you have any ideas to help fix this issue?

LipiPharm Lipi Pharm Lipi Pharm

CrestorPharm: Crestor Pharm – can i take rosuvastatin every other day

No doctor visit required statins: Crestor Pharm – Crestor Pharm

nursing implications for lipitor: atorvastatin leg cramps – LipiPharm

CrestorPharm Crestor Pharm Crestor mail order USA

No prescription diabetes meds online: Semaglu Pharm – how long is compounded semaglutide good for

Semaglu Pharm: what not to eat on semaglutide – Rybelsus for blood sugar control

http://lipipharm.com/# lipitor 10mg

Order rosuvastatin online legally Crestor home delivery USA п»їBuy Crestor without prescription

goodrx crestor: CrestorPharm – Crestor 10mg / 20mg / 40mg online

Semaglu Pharm: rybelsus 14 – semaglutide calculator

prednisone 40 mg tablet Predni Pharm prednisone canada pharmacy

https://semaglupharm.com/# Affordable Rybelsus price

semaglutide 6-week belly ozempic weight loss before and after: Online pharmacy Rybelsus – SemagluPharm

Crestor Pharm: can i cut crestor in half – Crestor Pharm

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

https://prednipharm.com/# PredniPharm

Discreet shipping for Lipitor Lipi Pharm pros and cons of lipitor

rosuvastatin side effect: CrestorPharm – Crestor Pharm

FDA-approved Rybelsus alternative: rybelsus 3 mg precio – SemagluPharm

Lipi Pharm atorvastatin good rx LipiPharm

CrestorPharm: CrestorPharm – rosuvastatin ingredients

PredniPharm: PredniPharm – Predni Pharm

http://semaglupharm.com/# low dose semaglutide

Crestor Pharm: when should you take crestor – Crestor Pharm

Generic Crestor for high cholesterol Generic Crestor for high cholesterol CrestorPharm

https://semaglupharm.shop/# does semaglutide help with pcos

SemagluPharm: Rybelsus for blood sugar control – No prescription diabetes meds online

Semaglu Pharm: Rybelsus side effects and dosage – Semaglu Pharm

rybelsus vs jardiance weight loss SemagluPharm SemagluPharm

https://semaglupharm.com/# SemagluPharm

Lipi Pharm: Lipi Pharm – LipiPharm

Predni Pharm: buy prednisone from canada – PredniPharm

rosuvastatin brand Crestor Pharm Rosuvastatin tablets without doctor approval

https://semaglupharm.com/# Semaglu Pharm

Lipi Pharm: LipiPharm – Atorvastatin online pharmacy

Crestor Pharm: what does crestor treat – Crestor Pharm

can crestor cause joint pain Crestor Pharm Online statin therapy without RX

https://semaglupharm.com/# FDA-approved Rybelsus alternative

can you buy prednisone over the counter in usa: prednisone canada – 200 mg prednisone daily

Semaglu Pharm: SemagluPharm – Semaglu Pharm

https://semaglupharm.com/# Semaglu Pharm

No doctor visit required statins CrestorPharm Crestor Pharm

In der kostenlosen Version kann man nicht gewinnen, aber man kann auch nicht verlieren. Im Demomodus können Sie die Höhe des Risikos ändern, mit Wetten experimentieren und beobachten, wie sich die Koeffizienten ändern. Wer die Spielmechanik verstehen will, hat mit Plinko kostenlos spielen die Möglichkeit, sich ohne finanzielle Verluste vorzubereiten. Datum der Erfahrung: 18. Mai 2025 Land-based casinos introduced in-person Plinko, when crypto casinos paved the way for the RNG-based alternative. Plinko will be popular for its high payout prospective of up in order to 99% your gamble! Play at the particular top Canadian Plinko casinos here, verified by our professionals for big get multipliers, high RTPs and various settlement methods,” “including cryptocurrencies. Thanks to be able to its relatively basic graphics, the Plinko casino game is definitely available on just about all devices and programs, including iOS and even Android smartphones. The Plinko APP is usually reliable as it makes use of Provably Fair technological innovation.

https://swaay.com/u/diegrilunna198550363/about/

Warnung : Investx ist eine unabhängige Website, die kostenlose Bewertungen anbietet. Wir bieten keine Echtgeld-Glücksspieldienste an. Alle Informationen auf der Website dienen ausschließlich der Unterhaltung und Information der Besucher. Glücksspiel ist in einigen Rechtsordnungen illegal. Es liegt in der Verantwortung der Besucher, die lokale Gesetzgebung zu überprüfen, bevor sie online spielen. Investx übernimmt keine Verantwortung für Ihre Handlungen. Plinko ist ein einfaches, aber spannendes Glücksspiel. Spieler lassen einen Ball auf ein Brett mit Stiften fallen, der zufällig in einen der Slots am unteren Ende des Bretts fällt. Jeder Slot repräsentiert einen Multiplikator oder eine Auszahlung. Seine zufällige Natur und die Möglichkeit, mit kleinen Einsätzen große Gewinne zu erzielen, machen es zu einem Favoriten unter Spielern.

Rybelsus 3mg 7mg 14mg: Semaglu Pharm – SemagluPharm

prednisone 2.5 mg cost: prednisone buy – prednisone price australia

https://semaglupharm.com/# Semaglu Pharm

6 prednisone prednisone PredniPharm

термин сөздік, қазақстан тарихы термин сөздер человек в футляре авторскаяпозиция, конфликт человек в футляре умеретьмолодым смотреть онлайн, ларри краун смотреть трейлер ана сүтін көбейту, сүт көбейтетін дəрі апилак

SemagluPharm: SemagluPharm – Semaglu Pharm

https://semaglupharm.shop/# que es semaglutide

lipitor or crestor: can rosuvastatin cause dementia – Crestor 10mg / 20mg / 40mg online

SemagluPharm semaglutide and fatigue rybelsus diabetes

http://semaglupharm.com/# SemagluPharm

п»їBuy Lipitor without prescription USA: atorvastatin nursing implications – LipiPharm

http://lipipharm.com/# how does lipitor make you feel

Affordable Rybelsus price: semaglutide cost with insurance – Semaglu Pharm

Semaglu Pharm SemagluPharm п»їBuy Rybelsus online USA

https://semaglupharm.shop/# Semaglu Pharm

prednisone 5 mg brand name: PredniPharm – prednisone sale

prednisone 2 mg: PredniPharm – prednisone cost 10mg

atorvastatin weight loss reviews Lipi Pharm when to take atorvastatin dosage

https://semaglupharm.com/# No prescription diabetes meds online

prednisone 10 mg price: Predni Pharm – Predni Pharm

Rosuvastatin tablets without doctor approval: CrestorPharm – Crestor home delivery USA

prednisone prices prednisone 40 mg rx PredniPharm

https://crestorpharm.com/# Online statin therapy without RX

https://semaglupharm.com/# SemagluPharm

what is the difference between tirzepatide and semaglutide: Affordable Rybelsus price – rybelsus active ingredient

Buy cholesterol medicine online cheap: CrestorPharm – Crestor Pharm

http://semaglupharm.com/# how long does semaglutide last in fridge

rybelsus vs ozempic weight loss: SemagluPharm – can you drink alcohol on semaglutide for weight loss

is crestor bad for your kidneys: how long does it take for rosuvastatin to lower cholesterol – CrestorPharm

PredniPharm prednisone 5mg daily Predni Pharm

https://semaglupharm.com/# SemagluPharm

canada online pharmacy: Canada Pharm Global – best online canadian pharmacy

Meds From Mexico: Meds From Mexico – Meds From Mexico

canadian world pharmacy canadian pharmacy store rate canadian pharmacies

http://medsfrommexico.com/# buying prescription drugs in mexico

canadian pharmacy oxycodone: canada pharmacy 24h – best mail order pharmacy canada

http://canadapharmglobal.com/# canadian drugs online

canadian pharmacy 24: Canada Pharm Global – buying from canadian pharmacies

https://indiapharmglobal.com/# online shopping pharmacy india

online canadian pharmacy review Canada Pharm Global reliable canadian pharmacy

¡Hola, apostadores expertos !

Casino sin licencia en EspaГ±ola sin lГmites – http://casinossinlicenciaespana.es/ casino online sin registro

¡Que experimentes éxitos destacados !

top 10 pharmacies in india: best india pharmacy – India Pharm Global

https://medsfrommexico.com/# Meds From Mexico

India Pharm Global: India Pharm Global – India Pharm Global

Meds From Mexico Meds From Mexico Meds From Mexico

Meds From Mexico: Meds From Mexico – mexico drug stores pharmacies

https://indiapharmglobal.com/# buy prescription drugs from india

¡Saludos, cazadores de fortuna !

Casinosextranjerosenespana.es – Toda la info actualizada – https://www.casinosextranjerosenespana.es/# casinos extranjeros

¡Que vivas increíbles jugadas excepcionales !

buying prescription drugs in mexico online: Meds From Mexico – buying from online mexican pharmacy

Meds From Mexico: Meds From Mexico – Meds From Mexico

https://canadapharmglobal.com/# canada rx pharmacy world

best online canadian pharmacy canadian mail order pharmacy canadian medications

India Pharm Global: India Pharm Global – India Pharm Global

india pharmacy: India Pharm Global – indian pharmacy paypal

https://canadapharmglobal.shop/# pharmacy rx world canada

https://indiapharmglobal.shop/# India Pharm Global

world pharmacy india indian pharmacy India Pharm Global

the canadian drugstore: Canada Pharm Global – ed meds online canada

world pharmacy india: india online pharmacy – reputable indian online pharmacy

http://canadapharmglobal.com/# canadian pharmacy online

Online medicine order indian pharmacies safe india pharmacy mail order

mexican online pharmacies prescription drugs: reputable mexican pharmacies online – п»їbest mexican online pharmacies

India Pharm Global: buy prescription drugs from india – top 10 pharmacies in india

https://medsfrommexico.shop/# best mexican online pharmacies

http://indiapharmglobal.com/# India Pharm Global

¡Hola, amantes del ocio !

Casino online fuera de EspaГ±a con ruleta europea – https://www.casinoonlinefueradeespanol.xyz/# casinoonlinefueradeespanol

¡Que disfrutes de asombrosas momentos memorables !

legitimate canadian pharmacies Canada Pharm Global canadian pharmacy world reviews

http://canadapharmglobal.com/# canadian neighbor pharmacy

canadian drug pharmacy: Canada Pharm Global – reliable canadian pharmacy

safe canadian pharmacy: canadian pharmacy ed medications – the canadian pharmacy

https://efarmaciait.shop/# farmacia loreto napoli recensioni

fotsopp apotek: rosenrot apotek – Rask Apotek

shop pharmacie: EFarmaciaIt – EFarmaciaIt

¡Saludos, amantes de la adrenalina !

CГіmo crear cuenta en casinos online extranjeros – п»їhttps://casinoextranjerosenespana.es/ casino online extranjero

¡Que disfrutes de tiradas afortunadas !

https://raskapotek.com/# hemoroide pute apotek

https://svenskapharma.shop/# corona test apotek

Papa Farma mounjaro precio espaГ±a Papa Farma

farmacias en venta alicante: Papa Farma – Papa Farma

hva koster influensavaksine pГҐ apotek: Rask Apotek – Rask Apotek

кухни на заказ недорого спб – это стильные решения по доступным ценам. пин ап вход: пинап казино – пин ап казино Het hoofdkantoor staat zowat naast de Johan Cruijff Arena. Bovendien heeft het overkoepelende bedrijf al een flinke geschiedenis op het internet en in de voetbaljournalistiek. Dit zorgt ervoor dat BetCity een echt Nederlands bedrijf is met echte know-how. De link met gewoon gokken is ook snel gelegd, doordat verschillende Amsterdamse gokhallen ook onder hetzelfde bedrijf vallen. Pour gagner beaucoup d’argent en jouant à Sweet Bonanza, il est essentiel de maîtriser le fonctionnement du jeu. Le mécanisme de Sweet Bonanza repose sur un système de paiement en cascade, où les icônes chutent sur les rouleaux et sont éliminées quand une combinaison victorieuse apparaît, permettant l’arrivée de nouvelles icônes.

https://anliacjonen1987.cavandoragh.org/https-ongemakkelijkekieswijzer-nl

Het live casino van Spinstarbet ziet er in ieder geval wel goed uit. Je krijgt meteen spellen als Lightning Roulette, Fireball Roulette Live, Crazy Time, Mega Ball en Dream Catcher te zien. Evolution staat dus paraat, maar ook Pragmatic Play Live is van de partij. Je mag dus meedoen met One Blackjack, Mega Roulette, Sweet Bonanza Candyland en Fortune Roulette. Het live casino van Spinstarbet ziet er in ieder geval wel goed uit. Je krijgt meteen spellen als Lightning Roulette, Fireball Roulette Live, Crazy Time, Mega Ball en Dream Catcher te zien. Evolution staat dus paraat, maar ook Pragmatic Play Live is van de partij. Je mag dus meedoen met One Blackjack, Mega Roulette, Sweet Bonanza Candyland en Fortune Roulette. Speel Buffalo King en ontdek alle Buffalo King Bonus Features – Gratis Spins

¡Saludos, participantes del juego !

casinos online extranjeros con juegos licenciados – п»їhttps://casinosextranjero.es/ п»їcasinos online extranjeros

¡Que vivas increíbles jugadas excepcionales !

http://svenskapharma.com/# Svenska Pharma

EFarmaciaIt contractubex crema 100 gr slowmet in gravidanza forum

EFarmaciaIt: EFarmaciaIt – magnesio aboca

Rask Apotek: l-serin pГҐ apotek – termometer apotek

https://svenskapharma.com/# Svenska Pharma

Papa Farma: Papa Farma – Papa Farma

middel mot klegg apotek Rask Apotek Rask Apotek

https://svenskapharma.shop/# Svenska Pharma

1000 farmacie sconto: capillarema compresse prezzo – EFarmaciaIt

influensa vaksine apotek: saltvann apotek – Rask Apotek

italia farmacia 24 recensioni normix sciroppo bambini efarma i miei ordini

https://papafarma.com/# opiniones farmacias top

vad betyder filmdragerad tablett: Svenska Pharma – Svenska Pharma

rea schampo Svenska Pharma mammakläder rea

Svenska Pharma: pelotter apotek – Svenska Pharma

https://efarmaciait.com/# farmacionline

Svenska Pharma: ringorm apotek – Svenska Pharma