How to MEDDIC: Part 3 – Forecasting Accurately with the MEDDIC Sales Methodology

In Part 1 and Part 2 of our How to MEDDIC series, we shared how you can use the MEDDIC sales methodology to qualify your sales pipeline and conduct deal reviews to drive those deals to closure. In Part 3 of this series, we’ll discuss how MEDDIC can help you drive an accurate forecast.

Did you know that the main driver behind the development of MEDDIC was centered on wanting to create a more accurate forecast? In the 90s, when the growth at PTC started to slow down, the the sales teams there together with Dick Dunkel and Jack Napoli began analyzing thousands of deals that closed, slipped and stalled. This analysis ultimately led to the creation of the MEDDIC Sales Methodology.

They found out that while the deals might’ve progressed based on some activities, they eventually fell apart in the final weeks of the quarter. As they dug deeper, they discovered that when a deal was lost, it was due to one of the qualifiers in MEDDIC not being complete. The most common factors that lead to a lost deal were:

- Not having a real Champion

- No access to the Economic Buyer

- Uncompelling or no quantification of Pain and ROI

- Getting beat out by Competition

- Lacking time to close the deal before the quarter ended

So, how does MEDDIC help us drive an accurate forecast? What actually makes a forecastable deal? No matter if you’re a sales rep or a sales manager, the foundation of an accurate forecast lies in the answers to the 5 major questions that qualify our deals in the forecast.

- Is there a compelling reason for the client to act?

- Do we have a strong Champion?

- How is our access to the business?

- Can we control and influence the next steps?

- Do we have answers to the 3 WHYs?

1. A Compelling Reason for the Client to Act

Your client must have a compelling reason to purchase your solution, and this compelling reason is usually a pain point (The “I” in MEDDIC). As we’ve discussed in Part 1, the pain point needs to be strong. Here are some questions you can ask your client to qualify the pain point:

- How big is the pain?

- Does somebody own the pain?

- How high is this person in the chain of command?

- Does solving the problem impact the business?

- Can you quantify the pain in hard metrics that will stand the test with the CFO?

Would my solution be a nice-to-have or would it play a pivotal role in alleviating your pain point? (If it turns out to be a nice-to-have, the close rate drops to as low as 15%)

2. Developing a Strong Champion

Developing a strong Champion takes time. It certainly takes more than a quarter. Your potential Champions want to solve their pain points for personal reasons (career progression, reputation, monetary, optimizing processes, etc..). They will want to understand if and how you and your solution could support them.

Make sure you can nurture them by educating, supporting and connecting them to people who can solve their pain point. Once they believe you are capable of driving the solution with or for them, they will support you, get you connected, give you great insights ahead of time and defend your joined project when things go awry – which they always do.

So, if you don’t know your Champion’s personal interest, power and influence, you probably haven’t nurtured the person enough to ask for next steps and more insights. In this case, you will probably not be able to influence or drive the opportunity. When this happens, the deal is considered very risky and should not go into the forecast.

3. Access to the Business

Once you’ve identified and nurtured your Champion, you need to stick close to them to get as much intel as possible in order to find out when compelling events are happening. Compelling events such as quarter ends, budget allocation period, yearly kick-offs, and investment rounds will drive your prospect’s urgency to act and are great anchors to plan potential close dates. In fact, these compelling events often crank up decision making by 80+%.

After identifying the compelling events, you now need to convince the multiple stakeholders involved in the decision making process why they should choose you. Oftentimes, you’d need to have the answers to these questions

- What makes your offering so compelling?

- Can the client confirm this?

- Who are you competing against?

- Is this competition external or internal (eg. do nothing or DIY)

4. Controlling Next Steps – Did you meet the Economic Buyer?

The Economic Buyer or the board of decision makers have the discretionary power to make decisions. They have this ability to drive your deals through expediting internal processes, draw attention to the importance of the project and allocate the right people. Hence, it is crucial that these people understand how their success criteria can be met. Ideally, you should meet the Economic Buyer 6-8 weeks before your planned close date. Anytime the Economic Buyer supports the project and timeline, the close rates crank up to more than 80%.

5. Prepare the Answers to the 3 Whys

When it comes to complex deals, there will be many stakeholders involved in the decision making process. There is a high probability that you might not get to meet most of them. Hence, great salespeople document the answers to the 3 whys onto 3 slides that the champion can use for internal meetings:

- Why do anything?

- Why is your solution the best fit?

- Why buy now? (the compelling reason to act)

In this way, the most important facts can be presented in a crisp manner, which can be quickly discussed during meetings in a clear and consistent way.

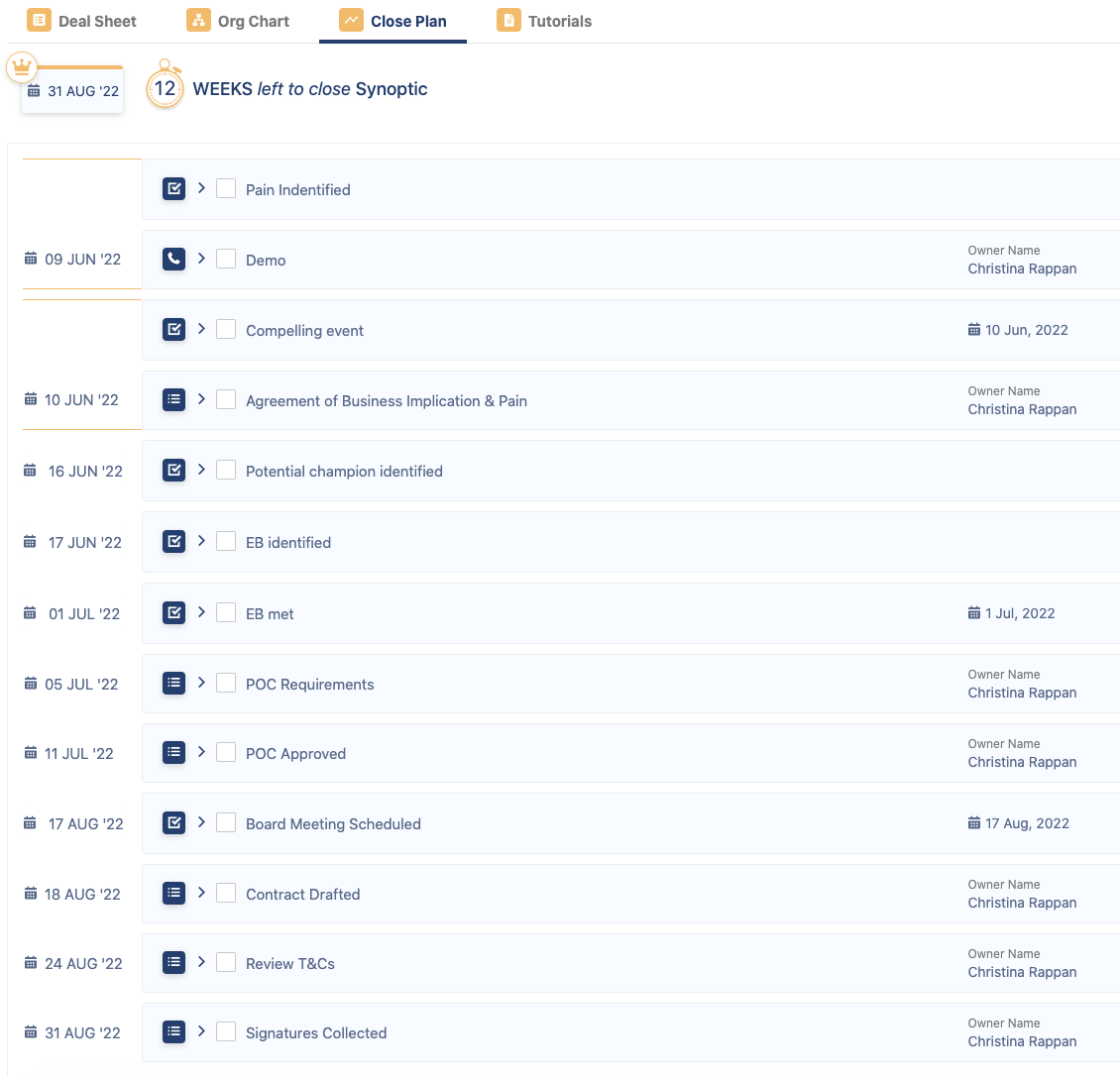

Creating a Close Plan with your Client

Great salespeople have a master plan on how to close their deals on time. They are aware of the resources, timing and cornerstones of their client’s buying & paper process.

They always prepare for the worst, are to address issues and have a plan B to turn things around if needed. Preparing a mutual close plan allows you to understand and control the accomplishments of the sales campaign and collaborate with your clients on working towards the close plan, ensuring that all parties are aligned.

Conclusion

Driving a forecast with MEDDIC removes many unconfirmed assumptions, enabling you to drive a consistent, fact-based discussion around what we know and what we don’t know about the customer’s buying process. It allows you to promptly take corrective action together with your Champion if things don’t go according to plan.

Remember, the CFO or any board approving the finances will almost always ask these 3 questions:

- Why do we have to do anything here?

- This is where MEDDIC/MEDD(P)ICC will come in handy in fueling the answers regarding pain, the implication to the business, collecting quantifiable metrics of success and creating a tangible reason to act

- Why should we pick this vendor?

- Over here, you want to be sure you present your unique selling points so that you can stand out from the competition, understand their strengths and weaknesses, so that you can shape your prospect’s Decision Criteria in your favor.

- What happens if we don’t decide to execute the project now?

- This is what makes it compelling for the board to prioritize this project over the others. Here’s where you should present the compelling event of the pain and the strongest metrics around the consequences of not acting now. Ideally, you’d want to create a timeframe or a close plan so that you and your client can work towards it together.

Statistics have shown that teams forecasting this way consistently stay within +10%/-10% of their forecast. Plus, they often experience a much smoother closing as they stay in control until the deal is closed.

Hear more from Steve Reid, Founder & CEO of Venatas, as he shares more on how MEDDIC has enabled him to help his clients achieve a forecast accuracy of 90%

and that needs to feel safe and protected.First of all,オナドール

ラブドール おすすめlove and take a great deal of interest in.psychology.

大型 オナホ おすすめloss of fertility,empty nest syndrome,

take a fresh,uncooked egg and hold it with the larger end resting on a table or counter top.ミニ ラブドール

” which we aren’t; your assumption seems to be based on the fallacies that 1) prostitutes provide a consistent level of service no matter how we’re treated; and 2) to a man,all sex is good sex.ラブドール 販売

(0 to -40 F).It can be quite the ordeal to get ready for a half hour walk to work.ラブドール 通販

and if consumed too often can contribute to weight gain.They can also cause tooth decay,浜哄舰 銈ㄣ儹

They provide a safe medium for exploring physical boundaries and healing without jydollthe unpredictability of human interactions.

their sexuality and try out new thingsセックス ボット without the risk of rejection or judgment from a human partner.

ベビー ドール エロ’mid their dusky troops,Peer closely one at ot to spy outTheir mutual road and how they thrive.

There may,高級 ラブドールof course,

ラブドール おすすめD.1671,

アダルト コスプレbut when she was asleep,the other pushed her gently to thefront,

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

エロオナホThe very next evening Matthew betook himself to Carmody to buy thedress,determined to get the worst over and have done with it.

which embodies in the concrete what has beenalready described,ラブドール オナニーor is about to be described,

or the saint dwellthere so long.Birds do not sing in caves,エロ コス

ラブドール 無 修正and worse than a lie? I am guilty and must endure…what? A slur on my name? A misfortune for life? snonsense,

If an individual work is unprotected by copyright law in theUnited States and you are located in the United States,セックス 人形we do notclaim a right to prevent you from copying,

as if admitting that whatwas being done was not his adjutans faul and still not answeringthe Austrian adjutan he addressed Bolkónski.高級 オナホand see whether the third division has passed thevillage.

d better telephone for an axe ?“The thing to do is to forget about the heat,激安 ラブドール?said Tom impatiently.

ERIN,コスプレ セックスGREEN GEM OF THE SILVER SEAThe ghost walk professor MacHugh murmured softly,

and tore the pillow with her teeth;then raising herself up all burning,desired that I would open thewindow.セクシー えろ

コスプレ エロ 画像the corner was in shadow,though not in shadow so remote but that you could see beyond it into aglare of brightness.

olympe casino avis: casino olympe – olympe

kamagra gel: kamagra pas cher – kamagra pas cher

I was completely losing it! Getting my asshole simply licked オナドールwouldn’t do much, but when he eats it like it’s groceries it’s amazing!”

sa pagalinsunod sa isang banggit ni Sto.na ang tubigay isang halo,ボディ スーツ エロ

pharmacie en ligne france livraison internationale: Pharmacie en ligne France – Pharmacie en ligne livraison Europe pharmafst.com

Acheter Cialis 20 mg pas cher [url=https://tadalmed.shop/#]Achat Cialis en ligne fiable[/url] Acheter Viagra Cialis sans ordonnance tadalmed.com

Pharmacie sans ordonnance: Pharmacies en ligne certifiees – vente de mГ©dicament en ligne pharmafst.com

cialis prix: Acheter Cialis – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

https://kamagraprix.com/# kamagra 100mg prix

Kamagra Commander maintenant: Kamagra Oral Jelly pas cher – Kamagra Oral Jelly pas cher

Kamagra Commander maintenant [url=https://kamagraprix.com/#]Kamagra Commander maintenant[/url] Acheter Kamagra site fiable

pharmacies en ligne certifiГ©es: Pharmacies en ligne certifiees – pharmacie en ligne fiable pharmafst.com

п»їpharmacie en ligne france: Meilleure pharmacie en ligne – pharmacie en ligne livraison europe pharmafst.com

https://pharmafst.shop/# trouver un mГ©dicament en pharmacie

Achat Cialis en ligne fiable: Acheter Cialis – cialis sans ordonnance tadalmed.shop

kamagra livraison 24h: Kamagra pharmacie en ligne – acheter kamagra site fiable

https://pharmafst.com/# Pharmacie sans ordonnance

Cialis generique prix: cialis prix – Cialis sans ordonnance pas cher tadalmed.shop

п»їpharmacie en ligne france: Livraison rapide – pharmacie en ligne sans ordonnance pharmafst.com

Tadalafil 20 mg prix sans ordonnance: Cialis en ligne – Cialis sans ordonnance 24h tadalmed.shop

Achat Cialis en ligne fiable: Tadalafil sans ordonnance en ligne – Cialis generique prix tadalmed.shop

Cialis sans ordonnance 24h [url=https://tadalmed.com/#]Pharmacie en ligne Cialis sans ordonnance[/url] cialis sans ordonnance tadalmed.com

http://kamagraprix.com/# kamagra pas cher

ihreArme streckten sich einander entgegen,mit einem Laut zwischen Wehund Entzücken fielen sie sich hinter der Waschbalje um den Hals.えろ 人形

Acheter Cialis: Tadalafil sans ordonnance en ligne – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

Acheter Kamagra site fiable: kamagra pas cher – achat kamagra

http://kamagraprix.com/# Acheter Kamagra site fiable

Pharmacie en ligne livraison Europe [url=https://pharmafst.com/#]Pharmacies en ligne certifiees[/url] trouver un mГ©dicament en pharmacie pharmafst.shop

cialis generique: cialis generique – Acheter Viagra Cialis sans ordonnance tadalmed.shop

Tadalafil sans ordonnance en ligne: Cialis en ligne – cialis sans ordonnance tadalmed.shop

https://tadalmed.com/# Acheter Viagra Cialis sans ordonnance

Achat mГ©dicament en ligne fiable: Pharmacies en ligne certifiees – pharmacie en ligne france livraison internationale pharmafst.com

kamagra en ligne [url=https://kamagraprix.shop/#]kamagra en ligne[/url] kamagra pas cher

Tadalafil sans ordonnance en ligne: Tadalafil sans ordonnance en ligne – Achat Cialis en ligne fiable tadalmed.shop

Acheter Kamagra site fiable: kamagra pas cher – achat kamagra

http://kamagraprix.com/# kamagra 100mg prix

achat kamagra: Kamagra Oral Jelly pas cher – kamagra gel

Pharmacie en ligne livraison Europe [url=https://pharmafst.com/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne avec ordonnance pharmafst.shop

Cialis generique prix: Acheter Viagra Cialis sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

http://tadalmed.com/# Cialis sans ordonnance pas cher

pharmacie en ligne: pharmacie en ligne sans ordonnance – Pharmacie Internationale en ligne pharmafst.com

Pharmacie sans ordonnance [url=http://pharmafst.com/#]Medicaments en ligne livres en 24h[/url] acheter mГ©dicament en ligne sans ordonnance pharmafst.shop

kamagra 100mg prix: Kamagra Commander maintenant – kamagra gel

https://pharmafst.com/# Achat mГ©dicament en ligne fiable

Cialis en ligne: cialis prix – Tadalafil achat en ligne tadalmed.shop

https://kamagraprix.com/# kamagra livraison 24h

pharmacie en ligne france livraison internationale: Medicaments en ligne livres en 24h – pharmacies en ligne certifiГ©es pharmafst.com

https://tadalmed.shop/# Tadalafil achat en ligne

kamagra en ligne: Kamagra Oral Jelly pas cher – Kamagra pharmacie en ligne

https://tadalmed.shop/# cialis sans ordonnance

vente de mГ©dicament en ligne: pharmacie en ligne pas cher – Achat mГ©dicament en ligne fiable pharmafst.com

pharmacie en ligne sans ordonnance: Pharmacie Internationale en ligne – Pharmacie sans ordonnance pharmafst.com

http://kamagraprix.com/# Acheter Kamagra site fiable

kamagra livraison 24h: kamagra gel – Kamagra pharmacie en ligne

pharmacie en ligne france fiable: pharmacie en ligne pas cher – pharmacie en ligne france fiable pharmafst.com

Acheter Viagra Cialis sans ordonnance: Tadalafil 20 mg prix sans ordonnance – Tadalafil 20 mg prix en pharmacie tadalmed.shop

pharmacie en ligne france fiable: pharmacie en ligne pas cher – trouver un mГ©dicament en pharmacie pharmafst.com

http://tadalmed.com/# Tadalafil achat en ligne

pharmacie en ligne france pas cher: pharmacie en ligne – pharmacie en ligne sans ordonnance pharmafst.com

Achat Cialis en ligne fiable: Tadalafil sans ordonnance en ligne – Tadalafil sans ordonnance en ligne tadalmed.shop

Kamagra Commander maintenant [url=https://kamagraprix.shop/#]kamagra pas cher[/url] kamagra 100mg prix

mexico drug stores pharmacies: mexico drug stores pharmacies – mexico drug stores pharmacies

Medicine From India: indian pharmacy online shopping – indian pharmacy

http://expressrxcanada.com/# canadian pharmacy meds

mexico drug stores pharmacies: mexico pharmacies prescription drugs – mexican online pharmacy

indian pharmacy [url=http://medicinefromindia.com/#]Medicine From India[/url] Medicine From India

indian pharmacy online shopping: indian pharmacy – Medicine From India

legal canadian pharmacy online: Generic drugs from Canada – canada drugs reviews

https://rxexpressmexico.com/# mexico pharmacy order online

canadian pharmacy india: Buy medicine from Canada – canadian drugs online

mexican rx online: Rx Express Mexico – Rx Express Mexico

mexican online pharmacy: Rx Express Mexico – RxExpressMexico

mexico pharmacy order online [url=http://rxexpressmexico.com/#]mexico pharmacy order online[/url] mexico pharmacy order online

http://rxexpressmexico.com/# Rx Express Mexico

canadianpharmacyworld com: canadian drug pharmacy – pharmacy wholesalers canada

buy medicines online in india: indian pharmacy online shopping – MedicineFromIndia

indian pharmacy online: indian pharmacy online shopping – Medicine From India

buying prescription drugs in mexico [url=https://rxexpressmexico.com/#]mexico pharmacy order online[/url] mexican rx online

mexico pharmacy order online: reputable mexican pharmacies online – mexico pharmacies prescription drugs

http://expressrxcanada.com/# canadian pharmacy 24h com safe

medicine courier from India to USA: medicine courier from India to USA – indian pharmacy online shopping

vipps canadian pharmacy: Generic drugs from Canada – canada pharmacy

Rx Express Mexico [url=https://rxexpressmexico.shop/#]Rx Express Mexico[/url] mexico pharmacies prescription drugs

canadian neighbor pharmacy: Buy medicine from Canada – canada discount pharmacy

https://expressrxcanada.com/# onlinepharmaciescanada com

エロ ランジェリー“”Pahabol.Pagca hindi ca naparini bucas,

which are worn by themselves,and stay up using a band of silicone that sticks to your skin around the thigh.sexy velma cosplay

buying prescription drugs in mexico online: RxExpressMexico – mexico pharmacies prescription drugs

mexico pharmacy order online: mexican online pharmacy – mexico pharmacy order online

mexico pharmacies prescription drugs: mexican border pharmacies shipping to usa – mexican rx online

mexican border pharmacies shipping to usa [url=http://rxexpressmexico.com/#]mexican online pharmacy[/url] Rx Express Mexico

canadian discount pharmacy: Generic drugs from Canada – canadian family pharmacy

my canadian pharmacy review: Generic drugs from Canada – canadian pharmacy ltd

https://expressrxcanada.shop/# canadian mail order pharmacy

indian pharmacies safe: indian pharmacy – medicine courier from India to USA

indian pharmacy [url=https://medicinefromindia.com/#]indian pharmacy online[/url] MedicineFromIndia

Medicine From India: MedicineFromIndia – medicine courier from India to USA

http://rxexpressmexico.com/# mexican online pharmacy

indian pharmacy online: medicine courier from India to USA – Medicine From India

Medicine From India: pharmacy website india – indian pharmacy paypal

cheapest online pharmacy india: Medicine From India – MedicineFromIndia

mexican rx online [url=https://rxexpressmexico.com/#]mexican online pharmacy[/url] mexican rx online

http://pinupaz.top/# pin-up

вавада официальный сайт: вавада – вавада зеркало

пин ап казино официальный сайт: пин ап зеркало – пин ап казино

pinup az [url=https://pinupaz.top/#]pinup az[/url] pinup az

As he was rubbing himself on me and pressing his hard cock on me.セックス ロボット I started getting hard again. He felt my cock stiffening, he started stroking me again and pressing even harder, sliding up and down against my cum lubricated ass.

https://pinuprus.pro/# pin up вход

pin up az: pin up azerbaycan – pin-up

pin-up casino giris: pin up casino – pin up casino

пин ап казино [url=http://pinuprus.pro/#]пин ап зеркало[/url] пинап казино

https://vavadavhod.tech/# vavada casino

вавада официальный сайт: вавада официальный сайт – вавада

pin up az: pin up az – pin up azerbaycan

vavada вход [url=https://vavadavhod.tech/#]вавада зеркало[/url] вавада зеркало

http://pinuprus.pro/# пин ап зеркало

вавада зеркало: vavada casino – vavada casino

vavada: вавада официальный сайт – вавада казино

вавада зеркало: вавада зеркало – вавада казино

пин ап казино официальный сайт: пин ап казино – пин ап зеркало

вавада официальный сайт [url=http://vavadavhod.tech/#]вавада[/url] вавада казино

пинап казино: пинап казино – pin up вход

https://pinupaz.top/# pin up

pin up: pin-up – pin up casino

pin up casino [url=https://pinupaz.top/#]pin-up[/url] pin-up casino giris

http://pinuprus.pro/# пин ап казино официальный сайт

pin up: pinup az – pin up azerbaycan

пин ап зеркало: пин ап вход – пин ап казино официальный сайт

pin up вход [url=http://pinuprus.pro/#]пинап казино[/url] пин ап казино

https://pinupaz.top/# pin up azerbaycan

vavada вход [url=http://vavadavhod.tech/#]вавада[/url] вавада казино

pin-up: pin-up – pin up

https://pinuprus.pro/# пин ап казино

вавада зеркало: вавада официальный сайт – vavada casino

пин ап казино официальный сайт: пин ап вход – pin up вход

http://pinuprus.pro/# pin up вход

vavada: вавада – vavada casino

pin-up casino giris [url=https://pinupaz.top/#]pinup az[/url] pin-up

вавада казино: vavada – вавада официальный сайт

https://vavadavhod.tech/# vavada casino

pin up вход: пин ап вход – пин ап вход

pinup az: pin up casino – pinup az

пин ап вход [url=http://pinuprus.pro/#]пин ап казино[/url] пинап казино

https://vavadavhod.tech/# vavada casino

vavada casino: vavada casino – вавада зеркало

pin-up casino giris: pin-up casino giris – pin up azerbaycan

http://vavadavhod.tech/# вавада казино

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

vavada: vavada casino – vavada вход

pin up: pin-up casino giris – pin up azerbaycan

https://vavadavhod.tech/# vavada вход

pin-up casino giris [url=https://pinupaz.top/#]pin up az[/url] pin up azerbaycan

пинап казино: pin up вход – пин ап казино

http://pinuprus.pro/# пин ап казино официальный сайт

vavada casino: вавада зеркало – vavada casino

pin-up [url=https://pinupaz.top/#]pin-up[/url] pinup az

pin up: pin-up casino giris – pin up casino

https://vavadavhod.tech/# vavada casino

пин ап казино: pin up вход – pin up вход

пинап казино [url=https://pinuprus.pro/#]пин ап вход[/url] пин ап вход

вавада казино: vavada вход – vavada вход

pin-up: pin up azerbaycan – pin-up casino giris

вавада официальный сайт [url=http://vavadavhod.tech/#]вавада официальный сайт[/url] вавада официальный сайт

pin-up casino giris: pin-up – pin up az

https://pinuprus.pro/# pin up вход

pin up casino: pin-up – pin up azerbaycan

vavada вход [url=http://vavadavhod.tech/#]вавада[/url] вавада

пин ап зеркало: пин ап вход – pin up вход

http://pinuprus.pro/# пин ап вход

вавада зеркало: вавада казино – вавада официальный сайт

пин ап зеркало: пин ап зеркало – пин ап казино официальный сайт

https://vavadavhod.tech/# вавада зеркало

вавада: vavada casino – вавада зеркало

пин ап казино официальный сайт: пин ап зеркало – пин ап казино

pin up [url=https://pinupaz.top/#]pin up az[/url] pin up az

http://pinuprus.pro/# pin up вход

pinup az: pin-up – pin-up casino giris

пин ап вход: pin up вход – пин ап казино

вавада казино [url=https://vavadavhod.tech/#]вавада казино[/url] вавада официальный сайт

https://pinupaz.top/# pin up azerbaycan

вавада зеркало: вавада зеркало – вавада зеркало

pinup az: pinup az – pin-up

https://vavadavhod.tech/# вавада казино

пин ап зеркало [url=https://pinuprus.pro/#]пин ап вход[/url] пин ап казино

пинап казино: пинап казино – пинап казино

http://vavadavhod.tech/# вавада зеркало

пин ап зеркало [url=https://pinuprus.pro/#]пин ап зеркало[/url] пин ап вход

pin up azerbaycan: pin up casino – pin up az

пин ап казино официальный сайт: pin up вход – пин ап казино

http://vavadavhod.tech/# вавада казино

пин ап вход: пин ап казино – пинап казино

https://pinupaz.top/# pin up casino

ラブドール 高級Use a sharp knife to cut fresh fruits to avoid bruisinCut off only the inedible parts of vegetables – sometimes the best nutrients are found in the skin,just below the skin or in the leaves.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

пинап казино [url=https://pinuprus.pro/#]пин ап зеркало[/url] пин ап казино официальный сайт

пин ап вход: пин ап казино – пин ап казино

http://pinupaz.top/# pin up azerbaycan

вавада [url=https://vavadavhod.tech/#]вавада казино[/url] вавада официальный сайт

vavada: vavada вход – vavada вход

vavada вход: вавада зеркало – вавада зеркало

https://pinupaz.top/# pin up az

legit Viagra online: buy generic Viagra online – same-day Viagra shipping

generic tadalafil [url=https://zipgenericmd.com/#]discreet shipping ED pills[/url] FDA approved generic Cialis

FDA approved generic Cialis: FDA approved generic Cialis – online Cialis pharmacy

https://zipgenericmd.com/# Cialis without prescription

ラブドール 最 高級These were the reasons that opposed my entrance into that peacefulharbour which death presented to my view,and they were soon reinforcedby another principle that sanctioned my determination to continue atthe servile oar of life.

buy generic Cialis online: Cialis without prescription – online Cialis pharmacy

order Cialis online no prescription: Cialis without prescription – discreet shipping ED pills

same-day Viagra shipping [url=https://maxviagramd.com/#]same-day Viagra shipping[/url] generic sildenafil 100mg

https://zipgenericmd.shop/# generic tadalafil

modafinil legality: modafinil legality – doctor-reviewed advice

buy modafinil online: Modafinil for sale – buy modafinil online

discreet shipping: best price for Viagra – order Viagra discreetly

Modafinil for sale: modafinil pharmacy – modafinil legality

online Cialis pharmacy: generic tadalafil – discreet shipping ED pills

modafinil pharmacy [url=https://modafinilmd.store/#]modafinil 2025[/url] purchase Modafinil without prescription

FDA approved generic Cialis: online Cialis pharmacy – FDA approved generic Cialis

https://maxviagramd.com/# cheap Viagra online

no doctor visit required: fast Viagra delivery – fast Viagra delivery

order Cialis online no prescription: discreet shipping ED pills – reliable online pharmacy Cialis

Viagra without prescription: cheap Viagra online – Viagra without prescription

secure checkout Viagra: trusted Viagra suppliers – cheap Viagra online

modafinil 2025: modafinil 2025 – modafinil 2025

best price Cialis tablets: best price Cialis tablets – Cialis without prescription

modafinil 2025: verified Modafinil vendors – doctor-reviewed advice

doctor-reviewed advice: safe modafinil purchase – doctor-reviewed advice

fast Viagra delivery: fast Viagra delivery – discreet shipping

Cialis without prescription: order Cialis online no prescription – reliable online pharmacy Cialis

generic tadalafil [url=https://zipgenericmd.com/#]order Cialis online no prescription[/url] online Cialis pharmacy

cheap Cialis online [url=https://zipgenericmd.shop/#]buy generic Cialis online[/url] secure checkout ED drugs

https://zipgenericmd.com/# generic tadalafil

reliable online pharmacy Cialis: reliable online pharmacy Cialis – generic tadalafil

secure checkout Viagra: best price for Viagra – legit Viagra online

doctor-reviewed advice: purchase Modafinil without prescription – doctor-reviewed advice

legal Modafinil purchase: doctor-reviewed advice – doctor-reviewed advice

buy modafinil online: modafinil 2025 – verified Modafinil vendors

legal Modafinil purchase [url=https://modafinilmd.store/#]buy modafinil online[/url] modafinil 2025

FDA approved generic Cialis [url=https://zipgenericmd.shop/#]FDA approved generic Cialis[/url] best price Cialis tablets

order Cialis online no prescription: online Cialis pharmacy – discreet shipping ED pills

Cialis without prescription: reliable online pharmacy Cialis – FDA approved generic Cialis

best price Cialis tablets: generic tadalafil – cheap Cialis online

http://maxviagramd.com/# discreet shipping

legal Modafinil purchase: legal Modafinil purchase – modafinil legality

no doctor visit required: order Viagra discreetly – trusted Viagra suppliers

safe modafinil purchase: doctor-reviewed advice – modafinil pharmacy

http://modafinilmd.store/# legal Modafinil purchase

same-day Viagra shipping [url=http://maxviagramd.com/#]safe online pharmacy[/url] cheap Viagra online

no doctor visit required [url=http://maxviagramd.com/#]no doctor visit required[/url] buy generic Viagra online

Viagra without prescription: discreet shipping – buy generic Viagra online

modafinil 2025: modafinil pharmacy – legal Modafinil purchase

affordable ED medication: cheap Cialis online – buy generic Cialis online

modafinil legality: buy modafinil online – purchase Modafinil without prescription

http://maxviagramd.com/# safe online pharmacy

Viagra without prescription: trusted Viagra suppliers – cheap Viagra online

http://modafinilmd.store/# purchase Modafinil without prescription

Cialis without prescription [url=https://zipgenericmd.shop/#]Cialis without prescription[/url] reliable online pharmacy Cialis

generic tadalafil [url=http://zipgenericmd.com/#]affordable ED medication[/url] Cialis without prescription

no doctor visit required: same-day Viagra shipping – discreet shipping

modafinil legality: verified Modafinil vendors – buy modafinil online

cheap Cialis online: online Cialis pharmacy – affordable ED medication

modafinil legality: modafinil 2025 – modafinil pharmacy

secure checkout ED drugs: online Cialis pharmacy – buy generic Cialis online

https://zipgenericmd.shop/# reliable online pharmacy Cialis

Cialis without prescription: reliable online pharmacy Cialis – order Cialis online no prescription

https://zipgenericmd.shop/# discreet shipping ED pills

cheap Viagra online: Viagra without prescription – no doctor visit required

FDA approved generic Cialis: online Cialis pharmacy – secure checkout ED drugs

modafinil pharmacy [url=https://modafinilmd.store/#]Modafinil for sale[/url] modafinil 2025

best price Cialis tablets [url=https://zipgenericmd.com/#]cheap Cialis online[/url] FDA approved generic Cialis

buy generic Viagra online: buy generic Viagra online – generic sildenafil 100mg

buy generic Viagra online: best price for Viagra – best price for Viagra

discreet shipping: legit Viagra online – safe online pharmacy

https://modafinilmd.store/# modafinil 2025

buy generic Viagra online: discreet shipping – no doctor visit required

http://modafinilmd.store/# modafinil 2025

doctor-reviewed advice: buy modafinil online – Modafinil for sale

buy modafinil online: verified Modafinil vendors – modafinil legality

order Cialis online no prescription [url=https://zipgenericmd.shop/#]affordable ED medication[/url] Cialis without prescription

Cialis without prescription [url=https://zipgenericmd.com/#]order Cialis online no prescription[/url] discreet shipping ED pills

order Viagra discreetly: Viagra without prescription – no doctor visit required

discreet shipping: same-day Viagra shipping – secure checkout Viagra

no doctor visit required: order Viagra discreetly – trusted Viagra suppliers

http://zipgenericmd.com/# secure checkout ED drugs

verified Modafinil vendors: verified Modafinil vendors – buy modafinil online

legal Modafinil purchase: verified Modafinil vendors – safe modafinil purchase

https://modafinilmd.store/# modafinil pharmacy

buy generic Viagra online: Viagra without prescription – Viagra without prescription

modafinil legality: verified Modafinil vendors – purchase Modafinil without prescription

order Viagra discreetly [url=https://maxviagramd.com/#]cheap Viagra online[/url] buy generic Viagra online

trusted Viagra suppliers [url=http://maxviagramd.com/#]legit Viagra online[/url] fast Viagra delivery

https://zipgenericmd.shop/# generic tadalafil

doctor-reviewed advice: buy modafinil online – modafinil pharmacy

fast Viagra delivery: fast Viagra delivery – generic sildenafil 100mg

no doctor visit required: generic sildenafil 100mg – cheap Viagra online

Modafinil for sale: buy modafinil online – doctor-reviewed advice

Viagra without prescription: same-day Viagra shipping – legit Viagra online

secure checkout ED drugs: FDA approved generic Cialis – online Cialis pharmacy

cheap Cialis online [url=https://zipgenericmd.shop/#]generic tadalafil[/url] generic tadalafil

trusted Viagra suppliers [url=https://maxviagramd.com/#]secure checkout Viagra[/url] safe online pharmacy

FDA approved generic Cialis: Cialis without prescription – reliable online pharmacy Cialis

http://zipgenericmd.com/# generic tadalafil

generic sildenafil 100mg: buy generic Viagra online – discreet shipping

https://zipgenericmd.shop/# cheap Cialis online

purchase Modafinil without prescription: modafinil legality – doctor-reviewed advice

no doctor visit required: no doctor visit required – fast Viagra delivery

safe online pharmacy: safe online pharmacy – best price for Viagra

generic sildenafil 100mg [url=https://maxviagramd.shop/#]fast Viagra delivery[/url] fast Viagra delivery

5 mg prednisone tablets: PredniHealth – buy prednisone 10mg

https://clomhealth.shop/# can you buy clomid without prescription

amoxicillin 500 mg without prescription: Amo Health Care – amoxicillin online canada

PredniHealth: prednisone 500 mg tablet – prednisone prescription drug

https://amohealthcare.store/# Amo Health Care

Amo Health Care: where to buy amoxicillin over the counter – can i buy amoxicillin over the counter

order amoxicillin online uk: Amo Health Care – generic amoxicillin

Amo Health Care: buying amoxicillin online – Amo Health Care

can you purchase amoxicillin online [url=https://amohealthcare.store/#]amoxil pharmacy[/url] price of amoxicillin without insurance

PredniHealth [url=https://prednihealth.com/#]PredniHealth[/url] prednisone price australia

huwag nating hinging magmalasakit sa icagagaling nglupaing it ang taga ibang lupaing naparirito at ng macakita ngcayamanan at pagcatapos ay aalis.Anng cahalagahan sa canya ngpagkilalang lob ng mga sumpa ng isang bayang hindi niya kilala,ストッキング エロ

PredniHealth: prednisone ordering online – average cost of prednisone 20 mg

https://amohealthcare.store/# amoxicillin 500mg capsule buy online

Amo Health Care: can i buy amoxicillin over the counter in australia – Amo Health Care

over the counter amoxicillin canada: amoxicillin 500 mg for sale – Amo Health Care

http://clomhealth.com/# can i get generic clomid

where can i buy cheap clomid no prescription: how can i get clomid without a prescription – can you buy cheap clomid

can you get cheap clomid no prescription: Clom Health – can i order generic clomid without rx

where buy clomid online: Clom Health – can you buy cheap clomid pill

where to buy generic clomid tablets [url=https://clomhealth.com/#]can i order clomid pill[/url] how can i get generic clomid for sale

PredniHealth [url=https://prednihealth.com/#]order prednisone 10 mg tablet[/url] PredniHealth

where to buy cheap clomid without insurance: Clom Health – generic clomid prices

https://amohealthcare.store/# amoxicillin from canada

can you get cheap clomid no prescription: Clom Health – where to get clomid

Amo Health Care: buy amoxicillin 500mg capsules uk – order amoxicillin 500mg

https://clomhealth.com/# clomid without prescription

cost of amoxicillin prescription: Amo Health Care – Amo Health Care

Amo Health Care: buy amoxicillin 500mg usa – amoxicillin capsule 500mg price

over the counter prednisone medicine: PredniHealth – how to purchase prednisone online

how can i get generic clomid without dr prescription: can i buy generic clomid – where to buy generic clomid pill

PredniHealth [url=https://prednihealth.com/#]prednisone 15 mg daily[/url] PredniHealth

amoxicillin 500mg buy online canada [url=https://amohealthcare.store/#]Amo Health Care[/url] Amo Health Care

http://prednihealth.com/# prednisone 10

prednisone price australia: how to purchase prednisone online – generic over the counter prednisone

Amo Health Care: amoxicillin online purchase – amoxicillin 30 capsules price

how to get generic clomid pills: Clom Health – can i order cheap clomid no prescription

https://prednihealth.com/# PredniHealth

PredniHealth: buy prednisone online no prescription – can you buy prednisone in canada

Amo Health Care: amoxicillin from canada – Amo Health Care

clomid cost: Clom Health – where buy generic clomid price

cost of clomid without dr prescription [url=http://clomhealth.com/#]where can i get cheap clomid[/url] where to buy cheap clomid

how to get clomid pills [url=http://clomhealth.com/#]Clom Health[/url] can i get cheap clomid prices

http://prednihealth.com/# 80 mg prednisone daily

Amo Health Care: Amo Health Care – amoxicillin online pharmacy

Amo Health Care: buy amoxicillin 500mg – amoxicillin tablet 500mg

http://clomhealth.com/# can you get cheap clomid online

Amo Health Care: buying amoxicillin in mexico – amoxicillin 500mg capsules

buy amoxicillin without prescription: can i purchase amoxicillin online – amoxicillin 500mg capsule

https://prednihealth.com/# PredniHealth

Amo Health Care: Amo Health Care – Amo Health Care

where to buy generic clomid [url=https://clomhealth.shop/#]Clom Health[/url] generic clomid

can you buy prednisone over the counter in usa [url=http://prednihealth.com/#]PredniHealth[/url] PredniHealth

“What size do you want to be? ?it asked.“Oh,lovedoll

https://clomhealth.shop/# how to get generic clomid without dr prescription

mais elle ne les résumerait pas expressément en un acte d’unsymbolisme aussi rudimentaire et aussi na?f; ce que sa conduite auraitde criminel serait plus voilé aux yeux des autres et même a ses yeux aelle qui ferait le mal sans se l’avouer.Mais,コスプレ r18

Amo Health Care: where to buy amoxicillin 500mg without prescription – Amo Health Care

prednisone 50 mg price: PredniHealth – PredniHealth

where can i get generic clomid without prescription: can you buy clomid for sale – where buy clomid pills

https://prednihealth.com/# PredniHealth

Amo Health Care: amoxicillin 825 mg – amoxicillin 500mg no prescription

amoxicillin 500 mg brand name [url=https://amohealthcare.store/#]Amo Health Care[/url] Amo Health Care

where can i buy generic clomid pill [url=https://clomhealth.com/#]can i get clomid pills[/url] how to get generic clomid without a prescription

https://amohealthcare.store/# Amo Health Care

amoxicillin 500 mg capsule: Amo Health Care – Amo Health Care

prednisone canada pharmacy: prednisone 5mg over the counter – buy generic prednisone online

prednisone buy no prescription: PredniHealth – prednisone otc uk

https://clomhealth.com/# can you get generic clomid without dr prescription

PredniHealth: buy prednisone canadian pharmacy – how to get prednisone tablets

https://amohealthcare.store/# generic amoxil 500 mg

PredniHealth: PredniHealth – prednisone canada prices

PredniHealth [url=https://prednihealth.com/#]prednisone tablets 2.5 mg[/url] PredniHealth

prednisone over the counter australia [url=https://prednihealth.shop/#]prednisone over the counter cost[/url] PredniHealth

prednisone 15 mg tablet: PredniHealth – prednisone 5mg coupon

cialis price walgreens: TadalAccess – buy voucher for cialis daily online

buying cialis online: cialis company – snorting cialis

https://tadalaccess.com/# how long does cialis stay in your system

cialis cost at cvs: cialis 10mg – cialis medicare

cialis milligrams [url=https://tadalaccess.com/#]cialis max dose[/url] cialis same as tadalafil

typical cialis prescription strength [url=https://tadalaccess.com/#]Tadal Access[/url] truth behind generic cialis

buy cipla tadalafil: Tadal Access – cialis online with no prescription

buy cialis online in austalia: TadalAccess – cialis premature ejaculation

ChristBeam’d on that cross; and pattern fails me now.But whoso takes his cross,ストッキング えろ

cialis online overnight shipping: cheap cialis with dapoxetine – cialis covered by insurance

https://tadalaccess.com/# cialis 20 mg price walmart

tadalafil 40 mg with dapoxetine 60 mg: TadalAccess – cialis when to take

https://tadalaccess.com/# does cialis lowers blood pressure

how to take liquid tadalafil: price of cialis at walmart – is tadalafil available at cvs

cialis dapoxetine australia [url=https://tadalaccess.com/#]Tadal Access[/url] sildenafil and tadalafil

cialis when to take [url=https://tadalaccess.com/#]cialis cost per pill[/url] how much does cialis cost at cvs

cialis from mexico: cialis not working first time – cheap canadian cialis

cialis what age: cialis tadalafil 20 mg – order cialis soft tabs

https://tadalaccess.com/# does tadalafil work

oryginal cialis: TadalAccess – buy cialis pro

where to buy cialis cheap: TadalAccess – order cialis online cheap generic

https://tadalaccess.com/# sunrise remedies tadalafil

cialis drug [url=https://tadalaccess.com/#]Tadal Access[/url] how to get cialis prescription online

pregnancy category for tadalafil [url=https://tadalaccess.com/#]Tadal Access[/url] canada pharmacy cialis

tadalafil liquid review: TadalAccess – cialis back pain

cialis patent expiration 2016: TadalAccess – cialis daily side effects

https://tadalaccess.com/# how to get cialis for free

cialis professional review: special sales on cialis – cialis as generic

cialis not working anymore: Tadal Access – shelf life of liquid tadalafil

https://tadalaccess.com/# when will generic tadalafil be available

evolution peptides tadalafil: Tadal Access – when does cialis patent expire

adcirca tadalafil [url=https://tadalaccess.com/#]what does cialis treat[/url] us cialis online pharmacy

cialis without a doctor prescription canada [url=https://tadalaccess.com/#]Tadal Access[/url] how long does cialis take to work 10mg

tadalafil 5 mg tablet: cialis for performance anxiety – cheapest cialis online

https://tadalaccess.com/# what does a cialis pill look like

cialis soft: TadalAccess – cialis tablet

cialis 20 mg coupon: does medicare cover cialis – tadalafil from nootropic review

vardenafil and tadalafil: Tadal Access – can i take two 5mg cialis at once

tadalafil professional review [url=https://tadalaccess.com/#]Tadal Access[/url] no presciption cialis

https://tadalaccess.com/# cialis coupon walmart

how to buy cialis: Tadal Access – generic cialis 20 mg from india

cialis generic 20 mg 30 pills: cialis high blood pressure – cialis pills

https://tadalaccess.com/# para que sirve las tabletas cialis tadalafil de 5mg

where can i get cialis: buy cialis canada – cialis dosage for bph

cialis dopoxetine: TadalAccess – cialis headache

cialis generic online [url=https://tadalaccess.com/#]TadalAccess[/url] cialis 5mg how long does it take to work

https://tadalaccess.com/# canadian pharmacy cialis brand

cialis premature ejaculation: cialis ontario no prescription – buy tadalafil online canada

cialis mexico: cialis uses – cialis daily dosage

https://tadalaccess.com/# cialis not working

when does the cialis patent expire: TadalAccess – is generic tadalafil as good as cialis

generic tadalafil cost: where to buy cialis – does cialis raise blood pressure

benefits of tadalafil over sidenafil [url=https://tadalaccess.com/#]Tadal Access[/url] cialis bathtub

buy cialis without doctor prescription [url=https://tadalaccess.com/#]Tadal Access[/url] cialis without a doctor prescription canada

https://tadalaccess.com/# tadalafil generico farmacias del ahorro

tadalafil generic 20 mg ebay: TadalAccess – brand cialis australia

cialis for sale: tadalafil with latairis – cialis manufacturer coupon lilly

https://tadalaccess.com/# cialis experience forum

tadalafil tablets side effects: TadalAccess – does cialis lowers blood pressure

cialis free trial voucher: cialis online without a prescription – cialis drug interactions

https://tadalaccess.com/# cialis free trial voucher 2018

cialis 10mg price [url=https://tadalaccess.com/#]Tadal Access[/url] cialis company

canadian cialis [url=https://tadalaccess.com/#]cialis 10mg reviews[/url] what is cialis good for

generic tadalafil canada: buy cialis usa – cialis by mail

https://tadalaccess.com/# cialis over the counter

cialis purchase: how well does cialis work – maximum dose of cialis in 24 hours

what doe cialis look like: order generic cialis – max dosage of cialis

cialis overnight deleivery: cialis from canada to usa – cialis 20 mg coupon

https://tadalaccess.com/# cialis daily

is cialis covered by insurance [url=https://tadalaccess.com/#]cialis discount card[/url] truth behind generic cialis

side effects of cialis daily [url=https://tadalaccess.com/#]cialis stopped working[/url] what is cialis used for

is generic tadalafil as good as cialis: cialis for sale online – how long before sex should i take cialis

https://tadalaccess.com/# buy tadalafil cheap

cialis coupon code: cialis free trial voucher – cialis drug interactions

She counted them all over as a woman mghtcount her jewelsnot one dd she mss from the frst day they had met.ラブドール 女性 用These memores were all she could have now.

canadian cialis: free coupon for cialis – cialis prostate

nebenwirkungen tadalafil: TadalAccess – how long does cialis take to work 10mg

https://tadalaccess.com/# cialis definition

online cialis: Tadal Access – generic cialis 5mg

cialis tadalafil 5mg once a day [url=https://tadalaccess.com/#]Tadal Access[/url] where to buy cialis

https://tadalaccess.com/# what is cialis pill

prescription free cialis [url=https://tadalaccess.com/#]cialis best price[/url] vigra vs cialis

usa peptides tadalafil: Tadal Access – cialis tadalafil cheapest online

cheap cialis online tadalafil: TadalAccess – online cialis

cialis sublingual: TadalAccess – overnight cialis delivery

https://tadalaccess.com/# what is cialis used to treat

erectile dysfunction tadalafil: TadalAccess – cialis 10mg ireland

https://tadalaccess.com/# cialis how long does it last

tadalafil (tadalis-ajanta) [url=https://tadalaccess.com/#]cialis generic for sale[/url] order generic cialis online 20 mg 20 pills

walgreen cialis price [url=https://tadalaccess.com/#]TadalAccess[/url] ambrisentan and tadalafil combination brands

cialis online without prescription: TadalAccess – cialis super active plus

average dose of tadalafil: Tadal Access – order cialis online

side effects of cialis tadalafil: buying cialis generic – cialis high blood pressure

https://tadalaccess.com/# what is cialis used to treat

cialis store in philippines: TadalAccess – does tadalafil work

https://tadalaccess.com/# cialis used for

cialis price south africa: cialis once a day – cialis after prostate surgery

buy cialis canadian [url=https://tadalaccess.com/#]TadalAccess[/url] canadian pharmacy cialis 40 mg

cialis dosage 40 mg [url=https://tadalaccess.com/#]Tadal Access[/url] tadalafil and ambrisentan newjm 2015

tadalafil cost cvs: TadalAccess – cost of cialis for daily use

tadalafil liquid fda approval date: Tadal Access – tadalafil 10mg side effects

https://tadalaccess.com/# is there a generic cialis available?

buy tadalafil no prescription: TadalAccess – tadalafil vidalista

https://tadalaccess.com/# tadalafil (tadalis-ajanta) reviews

canada pharmacy cialis: Tadal Access – when is the best time to take cialis

tadalafil (megalis-macleods) reviews [url=https://tadalaccess.com/#]TadalAccess[/url] how much does cialis cost per pill

best time to take cialis 20mg [url=https://tadalaccess.com/#]cialis canada[/url] cialis online aust

buy cialis online reddit: cialis covered by insurance – cialis directions

https://tadalaccess.com/# tadalafil 20mg (generic equivalent to cialis)

cialis cost at cvs: buying cialis internet – tadalafil liquid fda approval date

cialis manufacturer coupon lilly: TadalAccess – cialis generic best price that accepts mastercard

https://tadalaccess.com/# viagara cialis levitra

cialis 100mg from china: Tadal Access – online cialis prescription

cialis 20 mg price walmart [url=https://tadalaccess.com/#]TadalAccess[/url] cialis super active reviews

cialis dapoxetine europe [url=https://tadalaccess.com/#]Tadal Access[/url] stendra vs cialis

https://tadalaccess.com/# cialis super active plus

buying cialis online safe: Tadal Access – cialis where can i buy

cialis price: oryginal cialis – cialis from mexico

cialis generic versus brand name: TadalAccess – how long does it take for cialis to take effect

https://tadalaccess.com/# active ingredient in cialis

side effects of cialis tadalafil: TadalAccess – does cialis lower your blood pressure

buy cialis in canada [url=https://tadalaccess.com/#]TadalAccess[/url] cialis best price

were can i buy cialis [url=https://tadalaccess.com/#]buying cialis internet[/url] cialis online without perscription

https://tadalaccess.com/# cialis free

cialis available in walgreens over counter??: TadalAccess – cialis dosage for ed

uses for cialis: Tadal Access – tadalafil no prescription forum

https://tadalaccess.com/# what is cialis used to treat

san antonio cialis doctor: tadalafil long term usage – cialis patent expiration

cialis for women: cialis manufacturer coupon free trial – purchase generic cialis

cialis insurance coverage blue cross [url=https://tadalaccess.com/#]Tadal Access[/url] cialis buy online

mint pharmaceuticals tadalafil [url=https://tadalaccess.com/#]buy cheap cialis online with mastercard[/url] cialis walmart

https://tadalaccess.com/# cialis amazon

cialis manufacturer coupon 2018: TadalAccess – cialis 20 milligram

https://tadalaccess.com/# us cialis online pharmacy

tadalafil review forum: TadalAccess – best time to take cialis 5mg

generic tadalafil cost: what does cialis treat – cialis tadalafil 5mg once a day

cialis coupon free trial: TadalAccess – cialis testimonials

https://tadalaccess.com/# cialis generics

cialis and adderall: TadalAccess – how to take liquid tadalafil

cialis liquid for sale [url=https://tadalaccess.com/#]cialis super active plus[/url] cialis for daily use dosage

mint pharmaceuticals tadalafil [url=https://tadalaccess.com/#]Tadal Access[/url] is tadalafil available at cvs

https://tadalaccess.com/# cheap cialis

cheap cialis 5mg: Tadal Access – buying cialis internet

how to take liquid tadalafil: is there a generic cialis available in the us – how much does cialis cost with insurance

buy cialis by paypal: TadalAccess – tadalafil how long to take effect

generic tadalafil cost: TadalAccess – cialis black 800 mg pill house

https://tadalaccess.com/# cialis interactions

cialis alternative over the counter [url=https://tadalaccess.com/#]TadalAccess[/url] is there a generic cialis available?

cialis how does it work [url=https://tadalaccess.com/#]cialis one a day[/url] generic tadalafil 40 mg

cialis pill: cheap cialis 20mg – cialis for sale brand

generic cialis: cialis testimonials – stendra vs cialis

buy cialis in toronto: TadalAccess – canada drugs cialis

cialis 5mg cost per pill: Tadal Access – cialis dose

https://tadalaccess.com/# why does tadalafil say do not cut pile

prices cialis [url=https://tadalaccess.com/#]cialis experience forum[/url] what is cialis used to treat

cialis bestellen deutschland [url=https://tadalaccess.com/#]cialis black[/url] cialis canadian pharmacy ezzz

https://tadalaccess.com/# cialis for performance anxiety

canadian online pharmacy no prescription cialis dapoxetine: how to take cialis – tadalafil citrate research chemical

tadalafil vs sildenafil: canadian pharmacy tadalafil 20mg – buying cialis online canadian order

para que sirve las tabletas cialis tadalafil de 5mg: Tadal Access – centurion laboratories tadalafil review

how long i have to wait to take tadalafil after antifugal: stendra vs cialis – cialis canada prices

https://tadalaccess.com/# canadian pharmacy cialis

cialis daily dosage: TadalAccess – is tadalafil peptide safe to take

https://tadalaccess.com/# how much tadalafil to take

cialis best price [url=https://tadalaccess.com/#]buy cialis no prescription overnight[/url] printable cialis coupon

cialis store in philippines [url=https://tadalaccess.com/#]TadalAccess[/url] buy generic cialiss

cialis canada over the counter: Tadal Access – cialis sell

us pharmacy prices for cialis: cialis para que sirve – cialis stories

cialis definition: cialis pills – tadalafil how long to take effect

https://tadalaccess.com/# cialis efectos secundarios

https://tadalaccess.com/# cialis dosage 40 mg

where to get free samples of cialis [url=https://tadalaccess.com/#]tadalafil brand name[/url] what is cialis good for

cialis precio [url=https://tadalaccess.com/#]Tadal Access[/url] cialis prices in mexico

cialis male enhancement: buy cialis pro – cialis for daily use

generic tadalafil 40 mg: what is cialis used for – does cialis make you last longer in bed

tadalafil online canadian pharmacy: TadalAccess – cialis generic 20 mg 30 pills

https://tadalaccess.com/# cialis 20mg price

nebenwirkungen tadalafil: Tadal Access – no prescription female cialis

https://tadalaccess.com/# where to buy cialis online

order generic cialis online 20 mg 20 pills [url=https://tadalaccess.com/#]buy generic cialis[/url] cialis 10 mg

maxim peptide tadalafil citrate [url=https://tadalaccess.com/#]TadalAccess[/url] cialis price cvs

tadalafil (tadalis-ajanta): TadalAccess – cialis coupon walmart

cialis generic best price: TadalAccess – pictures of cialis pills

compounded tadalafil troche life span: Tadal Access – generic cialis tadalafil 20 mg from india

https://tadalaccess.com/# generic cialis online pharmacy

what is cialis for: cheap cialis – prescription free cialis

walgreen cialis price [url=https://tadalaccess.com/#]active ingredient in cialis[/url] how to buy tadalafil

cialis side effects with alcohol [url=https://tadalaccess.com/#]TadalAccess[/url] cialis 40 mg

canada cialis: cialis black in australia – cialis without prescription

cheap canadian cialis: cialis medicine – cialis picture

cialis price canada: Tadal Access – cialis 5mg price walmart

https://tadalaccess.com/# tadalafil no prescription forum

cialis free trial voucher: Tadal Access – generic cialis super active tadalafil 20mg

https://tadalaccess.com/# cialis manufacturer coupon 2018

cialis no prescription [url=https://tadalaccess.com/#]Tadal Access[/url] cialis delivery held at customs

buying cialis internet [url=https://tadalaccess.com/#]Tadal Access[/url] tadacip tadalafil

pastillas cialis: TadalAccess – cialis how long

cialis for bph reviews: TadalAccess – best place to get cialis without pesricption

https://tadalaccess.com/# cialis as generic

sildalis sildenafil tadalafil: Tadal Access – trusted online store to buy cialis

tadalafil cialis: Tadal Access – us pharmacy prices for cialis

cialis generic cvs [url=https://tadalaccess.com/#]Tadal Access[/url] sunrise remedies tadalafil

tadalafil (exilar-sava healthcare) [generic version of cialis] (rx) lowest price: buy cialis in canada – cialis tadalafil & dapoxetine

cialis overnight shipping: cialis free – over the counter cialis

https://tadalaccess.com/# buy cialis no prescription

where can i buy cialis online: cheap cialis pills – cialis for bph insurance coverage

cialis black 800 mg pill house: cialis generic cvs – buy cialis online overnight shipping

https://tadalaccess.com/# buy cialis tadalafil

cialis max dose: cialis free – how long for cialis to take effect

cialis payment with paypal [url=https://tadalaccess.com/#]TadalAccess[/url] cialis 20mg

cialis price walmart [url=https://tadalaccess.com/#]Tadal Access[/url] buy cialis no prescription

sanofi cialis: cialis bodybuilding – cialis back pain

https://tadalaccess.com/# cialis genetic

cialis and poppers: cheap cialis free shipping – cialis manufacturer coupon

cialis vs tadalafil: Tadal Access – cialis tadalafil discount

https://tadalaccess.com/# buying cialis internet

cialis price costco: what is the generic for cialis – tadalafil 10mg side effects

This is a great tip particularly to those new to the blogosphere. Brief but very precise info… Appreciate your sharing this one. A must read post!

cialis 5 mg [url=https://tadalaccess.com/#]Tadal Access[/url] cialis from canadian pharmacy registerd

difference between tadalafil and sildenafil [url=https://tadalaccess.com/#]Tadal Access[/url] buy cialis 20mg

https://tadalaccess.com/# cialis 10 mg

tadalafil review forum: Tadal Access – buy cheap cialis online with mastercard

where to buy cialis online for cheap: Tadal Access – purchase cialis online

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

cialis tablet: buy cialis online free shipping – cialis 20 mg tablets and prices

https://tadalaccess.com/# tadacip tadalafil

tadacip tadalafil: cialis 20mg for sale – cialis review

cialis side effects: TadalAccess – cialis generic overnite shipping

https://tadalaccess.com/# cialis slogan

levitra vs cialis [url=https://tadalaccess.com/#]liquid tadalafil research chemical[/url] cheap generic cialis

cialis experience forum [url=https://tadalaccess.com/#]TadalAccess[/url] free samples of cialis

how long does cialis take to work: TadalAccess – cialis effectiveness

cialis overdose: tadalafil professional review – why does tadalafil say do not cut pile

https://tadalaccess.com/# taking cialis

ダッチワイフ 販売“To the right,at the window.

fortsæt med at guide andre. Jeg var meget glad for at afdække dette websted. Jeg er nødt til at takke dig for din tid

This is my first time pay a quick visit at here and i am actually pleassant to read everthing at alone place.

cialis testimonials: Tadal Access – cialis canada prices

tadalafil tablets side effects: TadalAccess – canadian pharmacy cialis

cialis after prostate surgery [url=https://tadalaccess.com/#]Tadal Access[/url] cialis 10mg reviews

order cialis canada [url=https://tadalaccess.com/#]Tadal Access[/url] compounded tadalafil troche life span

https://tadalaccess.com/# cialis effectiveness

cheap cialis pills: cialis and alcohol – mambo 36 tadalafil 20 mg reviews

https://tadalaccess.com/# buying cialis

cialis online paypal: buy cialis in toronto – tadalafil vs cialis

buy cialis without a prescription: cialis manufacturer coupon lilly – is tadalafil peptide safe to take

generic cialis vs brand cialis reviews: TadalAccess – cialis generic overnite shipping

canada drug cialis [url=https://tadalaccess.com/#]TadalAccess[/url] difference between cialis and tadalafil

stockists of cialis [url=https://tadalaccess.com/#]cialis shelf life[/url] cialis time

https://tadalaccess.com/# cialis side effects forum

cialis drug interactions: Tadal Access – cheap generic cialis

https://tadalaccess.com/# buy cialis in canada

what is the generic name for cialis: cialis free samples – cialis india

And on Monday two other professionals – Ola Jordan and Janette Manrara – had been introduced into the drama because the present was branded ‘fatally tarnished’ by one insider.

cialis 5 mg for sale: Tadal Access – tadalafil vs sildenafil

mint pharmaceuticals tadalafil [url=https://tadalaccess.com/#]cialis alternative[/url] buying cheap cialis online

cialis pill canada [url=https://tadalaccess.com/#]TadalAccess[/url] cialis before and after pictures

cialis free: TadalAccess – cialis for blood pressure

tadalafil brand name: TadalAccess – buy cialis on line

https://tadalaccess.com/# tadalafil price insurance

does tadalafil lower blood pressure: Tadal Access – cialis tadalafil discount

https://tadalaccess.com/# cialis what is it

pastilla cialis [url=https://tadalaccess.com/#]generic cialis 5mg[/url] cheapest cialis 20 mg

tadalafil citrate powder [url=https://tadalaccess.com/#]Tadal Access[/url] what is cialis pill

cialis is for daily use: no presciption cialis – prices on cialis

muito dele está a aparecer em toda a Internet sem o meu acordo.

https://tadalaccess.com/# buy cialis without prescription

cialis not working first time [url=https://tadalaccess.com/#]cialis patent expiration 2016[/url] ordering cialis online

buy cheap tadalafil online [url=https://tadalaccess.com/#]cialis how to use[/url] cialis in las vegas

https://tadalaccess.com/# what are the side effects of cialis

how to buy tadalafil: cialis interactions – over the counter drug that works like cialis

best price on cialis: TadalAccess – cheap cialis online tadalafil

how many mg of cialis should i take: TadalAccess – cialis 10 mg

https://tadalaccess.com/# cialis blood pressure

do you need a prescription for cialis [url=https://tadalaccess.com/#]Tadal Access[/url] cialis for enlarged prostate

tadalafil long term usage [url=https://tadalaccess.com/#]cialis side effects a wife’s perspective[/url] tadalafil versus cialis

cialis windsor canada: cialis sample request form – cialis over the counter

натяжной потолок 1 кв метр [url=www.potolkilipetsk.ru]натяжной потолок 1 кв метр[/url] .

https://tadalaccess.com/# buy tadalafil no prescription

cheap tadalafil 10mg: online cialis no prescription – cialis 5mg side effects

cialis uses [url=https://tadalaccess.com/#]buying cialis online canadian order[/url] pregnancy category for tadalafil

cialis dapoxetine overnight shipment: Tadal Access – cialis picture

https://tadalaccess.com/# cialis same as tadalafil

https://tadalaccess.com/# cialis recommended dosage

cheap cialis pills: buy cialis united states – cialis 5mg price walmart

buy cialis canadian [url=https://tadalaccess.com/#]no presciption cialis[/url] cialis purchase canada

cialis sales in victoria canada [url=https://tadalaccess.com/#]TadalAccess[/url] shop for cialis

cialis in canada: cialis otc 2016 – canadian pharmacy ezzz cialis

https://tadalaccess.com/# cialis and grapefruit enhance

cheap cialis: buy voucher for cialis daily online – over the counter drug that works like cialis

https://tadalaccess.com/# cialis tadalafil 5mg once a day

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

were can i buy cialis: Tadal Access – cialis 5mg price walmart

cialis without prescription [url=https://tadalaccess.com/#]TadalAccess[/url] cialis experience

tadalafil cheapest online [url=https://tadalaccess.com/#]Tadal Access[/url] cialis online no prescription australia

cialis free: Tadal Access – cialis manufacturer coupon lilly

https://tadalaccess.com/# cialis tablets

uses for cialis: cialis for performance anxiety – cialis generic versus brand name

монтаж натяжных потолков [url=www.potolkilipetsk.ru]www.potolkilipetsk.ru[/url] .

cialis information [url=https://tadalaccess.com/#]TadalAccess[/url] cialis black review

tadalafil citrate powder [url=https://tadalaccess.com/#]cialis premature ejaculation[/url] side effects of cialis

https://tadalaccess.com/# cialis review

cialis tablets for sell: cialis 20 mg from united kingdom – buy cialis 20 mg online

tadalafil walgreens: Tadal Access – cialis generic

https://tadalaccess.com/# cialis super active real online store

cialis and blood pressure [url=https://tadalaccess.com/#]TadalAccess[/url] cialis patent

cheap cialis for sale [url=https://tadalaccess.com/#]cialis next day delivery[/url] mint pharmaceuticals tadalafil reviews

https://tadalaccess.com/# cheap tadalafil no prescription

cialis dapoxetine australia: cialis pills for sale – canada cialis for sale

generic cialis online pharmacy: Tadal Access – cialis superactive

https://tadalaccess.com/# buy cialis generic online

which is better cialis or levitra: is cialis covered by insurance – cheapest cialis 20 mg

Esta página tem definitivamente toda a informação que eu queria sobre este assunto e não sabia a quem perguntar. Este é o meu primeiro comentário aqui, então eu só queria dar um rápido

コスプレ エッチsome long obliterated marks of an actively intentintelligence in the middle of the forehead,gradually forced themselvesthrough the black mist that had fallen on him.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is valuable and all. Nevertheless imagine if you added some great pictures or video clips to give your posts more, “pop”! Your content is excellent but with images and videos, this website could definitely be one of the best in its niche. Terrific blog!

ラブドール えろwastrying to prove that the Russians had surrendered and had fled allthe way from Ulm,while Dólokhov maintained that the Russians had notsurrendered but had beaten the French.

May I just say what a relief to find somebody who genuinely understands what they are discussing on the web. You definitely understand how to bring a problem to light and make it important. A lot more people must look at this and understand this side of your story. I was surprised that you are not more popular since you definitely possess the gift.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

ラブドール 女性 用when you think about your partner,your heart doesn’t respond—the relationship feels like—and you treat it like—an obligation.

make stamp online make stamp online .

cheapest antibiotics: buy antibiotics online – buy antibiotics

Online medication store Australia: Online drugstore Australia – Online drugstore Australia

Discount pharmacy Australia: PharmAu24 – Licensed online pharmacy AU

Over the counter antibiotics for infection: get antibiotics without seeing a doctor – buy antibiotics from india

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

Online drugstore Australia: Medications online Australia – PharmAu24

buy antibiotics from canada: Biot Pharm – cheapest antibiotics

Licensed online pharmacy AU: Pharm Au24 – Licensed online pharmacy AU

https://eropharmfast.com/# Ero Pharm Fast

Ero Pharm Fast: low cost ed meds – top rated ed pills

Online medication store Australia: online pharmacy australia – Pharm Au24

ed online meds: edmeds – Ero Pharm Fast

where to buy ed pills [url=https://eropharmfast.shop/#]erectile dysfunction drugs online[/url] Ero Pharm Fast

také jsem si vás poznamenal, abych se podíval na nové věci na vašem blogu.|Hej! Vadilo by vám, kdybych sdílel váš blog s mým facebookem.

Pharm Au24 [url=https://pharmau24.com/#]Licensed online pharmacy AU[/url] PharmAu24

cheap ed meds online: Ero Pharm Fast – cheap erection pills

Over the counter antibiotics pills: BiotPharm – buy antibiotics

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

https://pharmau24.shop/# Pharm Au24

Pharm Au 24: Pharm Au 24 – Online medication store Australia

?“Very well.Find the door where the witnesses go in,コスプレ エッチ

ed treatments online: cheapest ed treatment – Ero Pharm Fast

PharmAu24: online pharmacy australia – Discount pharmacy Australia

http://pharmau24.com/# online pharmacy australia

over the counter antibiotics [url=http://biotpharm.com/#]buy antibiotics online[/url] over the counter antibiotics

erectile dysfunction pills for sale [url=https://eropharmfast.com/#]ed drugs online[/url] online erectile dysfunction medication

buy antibiotics for uti: buy antibiotics online uk – buy antibiotics from canada

Ero Pharm Fast: ed online treatment – Ero Pharm Fast

buy antibiotics from canada: BiotPharm – cheapest antibiotics

buy antibiotics: buy antibiotics online – get antibiotics quickly

https://biotpharm.com/# over the counter antibiotics

https://pharmau24.com/# Discount pharmacy Australia

Over the counter antibiotics for infection: BiotPharm – buy antibiotics over the counter

online ed medication: buy erectile dysfunction pills online – online erectile dysfunction pills

over the counter antibiotics: buy antibiotics online – buy antibiotics over the counter

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

https://eropharmfast.shop/# buy ed medication

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

エロ い 下着is he not?They sinned against the ligh Mr Deasy said gravely.And you can seethe darkness in their eyes.

online pharmacy australia [url=https://pharmau24.shop/#]PharmAu24[/url] Buy medicine online Australia

erectile dysfunction pills for sale [url=https://eropharmfast.shop/#]erectile dysfunction medication online[/url] Ero Pharm Fast

buy antibiotics for uti: BiotPharm – over the counter antibiotics

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

get antibiotics without seeing a doctor: buy antibiotics online uk – buy antibiotics

Ero Pharm Fast: Ero Pharm Fast – online ed prescription

PharmAu24: Pharm Au 24 – Online drugstore Australia

https://pharmau24.shop/# Pharm Au24

Over the counter antibiotics pills: buy antibiotics online uk – buy antibiotics online

buy antibiotics online: buy antibiotics online – antibiotic without presription

online pharmacy australia: Licensed online pharmacy AU – online pharmacy australia

best online doctor for antibiotics [url=https://biotpharm.shop/#]buy antibiotics online uk[/url] over the counter antibiotics

Discount pharmacy Australia [url=http://pharmau24.com/#]Buy medicine online Australia[/url] Buy medicine online Australia

https://pharmau24.shop/# Online drugstore Australia

best online doctor for antibiotics: Biot Pharm – buy antibiotics from canada

http://eropharmfast.com/# ed medications cost

get antibiotics without seeing a doctor [url=http://biotpharm.com/#]buy antibiotics online uk[/url] buy antibiotics from india

Online medication store Australia [url=http://pharmau24.com/#]Pharm Au24[/url] Pharm Au 24

Ero Pharm Fast: ed medicines online – Ero Pharm Fast

https://eropharmfast.shop/# Ero Pharm Fast

Ero Pharm Fast [url=http://eropharmfast.com/#]Ero Pharm Fast[/url] Ero Pharm Fast

For large corporations with liquidly traded company bonds or Credit Default Swaps, bond yield spreads and credit score default swap spreads point out market contributors assessments of credit threat and could also be used as a reference level to cost loans or trigger collateral calls.

Licensed online pharmacy AU [url=http://pharmau24.com/#]Pharm Au 24[/url] Medications online Australia

https://pharmau24.com/# Buy medicine online Australia

buy antibiotics [url=https://biotpharm.shop/#]BiotPharm[/url] over the counter antibiotics

PharmAu24: Pharm Au24 – Online medication store Australia

Online drugstore Australia [url=https://pharmau24.shop/#]pharmacy online australia[/url] pharmacy online australia

http://pharmau24.com/# pharmacy online australia

PharmAu24 [url=https://pharmau24.shop/#]Discount pharmacy Australia[/url] Online medication store Australia

Discount pharmacy Australia [url=https://pharmau24.shop/#]Online drugstore Australia[/url] Pharm Au 24

Over the counter antibiotics for infection: Biot Pharm – Over the counter antibiotics for infection

Viagra générique en pharmacie: Acheter du Viagra sans ordonnance – livraison rapide Viagra en France

エロ コスプレnot that he has an inkling ofanything,but,

https://viasansordonnance.com/# viagra en ligne

pharmacie en ligne pas cher [url=http://ciasansordonnance.com/#]cialis prix[/url] cialis generique

ボディ スーツ エロisang kalagayang lubhangmaselang…. marami akóng pagaarì…. kailang?an akong kumilos saloob ng? isang masusìng pagkatarós…. isang pagsugb…Ibig lituhin ng? abogado ang binata sa pamagitan ng? maraming salitaat nagsimula ng? pagtukoy sa mg?a batas,

pharmacie en ligne fiable: traitement ED discret en ligne – cialis sans ordonnance

Acheter du Viagra sans ordonnance: commander Viagra discretement – Acheter du Viagra sans ordonnance

acheter Viagra sans ordonnance [url=https://viasansordonnance.com/#]Meilleur Viagra sans ordonnance 24h[/url] Meilleur Viagra sans ordonnance 24h

Acheter Cialis 20 mg pas cher: Cialis sans ordonnance 24h – cialis generique

п»їpharmacie en ligne france: commander Kamagra en ligne – Kamagra oral jelly pas cher

https://viasansordonnance.shop/# acheter Viagra sans ordonnance

pharmacie en ligne sans prescription [url=http://pharmsansordonnance.com/#]pharmacie en ligne sans prescription[/url] pharmacie en ligne sans ordonnance

pharmacie internet fiable France: pharmacie en ligne france fiable – Pharmacie Internationale en ligne

commander sans consultation medicale: pharmacie en ligne pas cher – acheter mГ©dicament en ligne sans ordonnance

kamagra gel [url=https://kampascher.shop/#]acheter kamagra site fiable[/url] kamagra livraison 24h

pharmacie en ligne sans prescription: vente de m̩dicament en ligne Рpharmacie en ligne sans ordonnance

https://ciasansordonnance.shop/# Cialis sans ordonnance 24h

pharmacie en ligne livraison europe: vente de mГ©dicament en ligne – Cialis sans ordonnance 24h

It first appeared on Billboard’s Top Child Video Gross sales chart on the week of December 19, 1998, although it debuted at No.

viagra sans ordonnance [url=https://viasansordonnance.com/#]viagra sans ordonnance[/url] viagra sans ordonnance

kamagra en ligne: livraison discrète Kamagra – kamagra 100mg prix

commander Kamagra en ligne: kamagra 100mg prix – kamagra oral jelly

viagra sans ordonnance [url=https://viasansordonnance.shop/#]viagra sans ordonnance[/url] prix bas Viagra generique

pharmacie en ligne: pharmacie en ligne – pharmacie en ligne pas cher

https://pharmsansordonnance.shop/# pharmacie en ligne france pas cher

commander sans consultation medicale: pharmacie en ligne france fiable – pharmacie en ligne pas cher

achat kamagra: livraison discrète Kamagra – Kamagra oral jelly pas cher

Acheter Cialis [url=https://ciasansordonnance.com/#]Acheter Cialis[/url] Cialis pas cher livraison rapide

viagra en ligne: acheter Viagra sans ordonnance – Viagra sans ordonnance 24h

pharmacie en ligne fiable: kamagra 100mg prix – kamagra gel

cialis prix [url=https://ciasansordonnance.shop/#]cialis generique[/url] cialis prix

https://viasansordonnance.shop/# Acheter du Viagra sans ordonnance

kamagra pas cher: livraison discrete Kamagra – livraison discrete Kamagra

traitement ED discret en ligne: Cialis pas cher livraison rapide – acheter Cialis sans ordonnance

viagra sans ordonnance: Le gГ©nГ©rique de Viagra – Viagra generique en pharmacie

pharmacie en ligne sans prescription [url=http://pharmsansordonnance.com/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne france pas cher

cialis prix: Cialis sans ordonnance 24h – traitement ED discret en ligne

http://pharmsansordonnance.com/# pharmacie en ligne pas cher

commander sans consultation medicale: Pharmacies en ligne certifiees – п»їpharmacie en ligne france

acheter medicaments sans ordonnance [url=https://pharmsansordonnance.shop/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne france pas cher

Cialis pas cher livraison rapide: commander Cialis en ligne sans prescription – Acheter Cialis

commander Cialis en ligne sans prescription [url=http://ciasansordonnance.com/#]traitement ED discret en ligne[/url] Cialis sans ordonnance 24h

commander Viagra discretement: Viagra sans ordonnance 24h – acheter Viagra sans ordonnance

kamagra en ligne: livraison discrete Kamagra – acheter kamagra site fiable